Last year, Rally Rd. launched on Product Hunt with its investment platform that let anyone buy or sell equity in exotic cars. Last week, the company returned to PH to expand its investment offerings to include wine, whiskey, watches, rare books and other luxury goods. 👀

Rally Rd. ($9.9M raised) is part of a new wave of fintech startups focused on equity-based alternative investments. It’s the 21st century version of building a portfolio. 💸

“When we built V1 of Rally in 2016, we started by making Classic Car investing accessible to everyone — but the vision was always about creating a new paradigm in equity ownership. Since launch, we’ve completed close to 40 Initial Offerings, created true liquidity in alternative assets, and opened our first retail showroom in NY so that everyone can have access to the rarest collectibles on the planet. This week we took the next step in that mission and officially released our next 3 asset offerings: Sports Memorabilia, Vintage Books, and Rare Timepieces, all within the Rally Rd. app,” - Rally Rd. co-founder Rob Petrozzo

What Petrozzo means by “Initial Offerings” is that Rally Rd. prices the “asset” (whether it be a rare Mustang or a first edition Harry Potter book) based on comparable asset values and social data, and then splits the car into shares to run an SEC-qualified Initial Offering. It’s like a mini IPO.

But do people actually think alternative investing can generation a return? Some thoughts from the PH community:

“I've been a happy Rally shareholder since their first car's launch – a 1955 Porsche – and can't wait to invest in their newest asset classes. These are financial investments first and foremost, but there's nothing quite like holding one of these stock certificates, knowing it represents a part of something I dream of calling my own.” - Nick

“These guys get it and are delivering an easy and beautifully designed framework on which to research and trade.” - William

For the record, collectible assets have consistent histories of appreciation — this method of investing simply democratizes the process. For more alternative investments, there’s also Masterworks and Arthena for investing in art (though you need to have a net worth over $1M for this one). And there’s Mythic Markets for investing in fandom collectibles. Last week, Skillshare founder Michael Karnjanaprakorn launched Otis, a platform for fractional ownership of items like Supreme skateboard decks, vintage comic books and a KAWS tondo painting.

We expect to see a continued rise of fractional ownership startups. Would you invest tiny amounts into collectible assets? Tell us in the comments. 💬

"This is so much fun."

Ask the Tarot-o-bot, mother of tech updates and design trends, what it sees for our future. 🔮

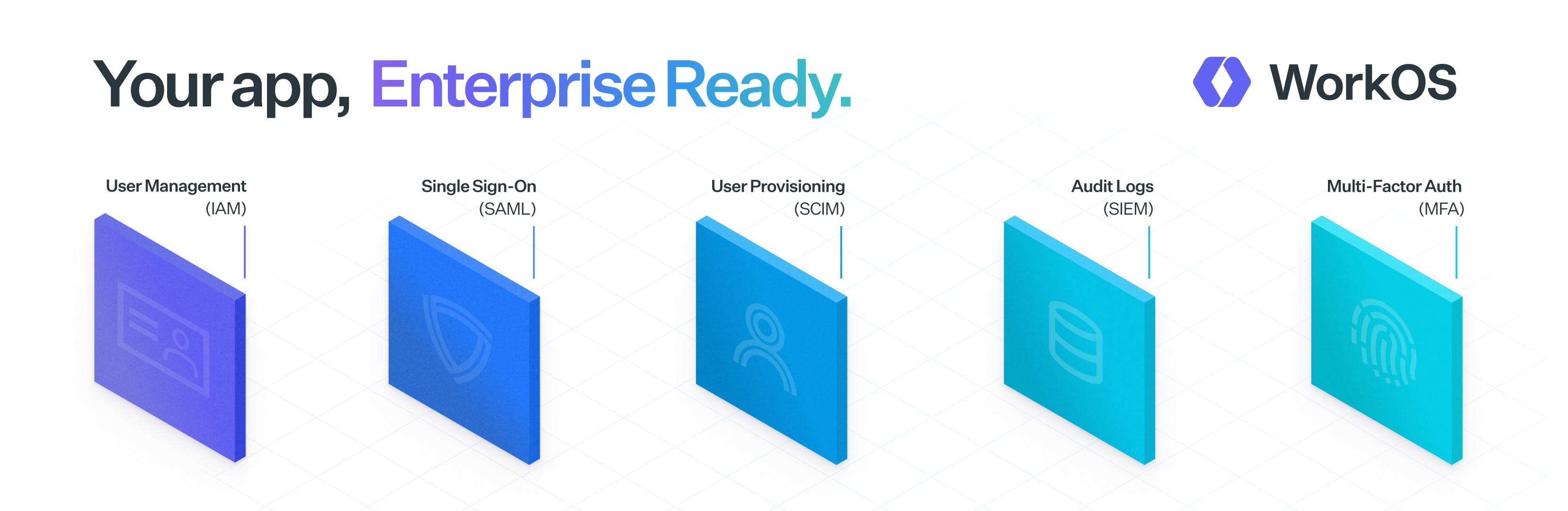

WorkOS is a modern identity and user management platform that enables B2B SaaS companies to accelerate enterprise adoption. Free up to 1 million MAUs, WorkOS brings a modular approach to B2B Auth with enterprise-ready features like SSO, SCIM, and User Management.

The APIs are flexible and easy to use, designed to provide an effortless experience from your first user all the way through your largest enterprise customer.

Today, hundreds of high-growth scale-ups are already powered by WorkOS, including ones you probably know, like Vercel, Webflow, and Loom.