Launched this week

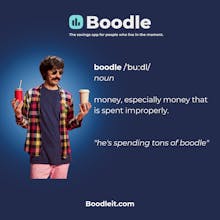

Boodle

Didn't spend it? Boodle it!

10 followers

Didn't spend it? Boodle it!

10 followers

The savings app for people who live in the moment, save on the little things you like to enjoy the big things you love. Boodle was made for real people with real spending habits. No Budgets. No guilt. No stress. Just smart, seamless saving — your way.

@andy_peart I’ve been surprised at actually how my behaviour changed during the beta. My biggest vice was buying lunch and not keeping track of just how much I was spending. Once I got into the habit of boodling how much I wasn’t spending, it became quite addictive and I’ve stuck to it.

Amazingly those little savings really start to add up over the months.

Really hope people try it out as it’s such a great idea and can genuinely save you money.

Best of luck!!

Congratulations on the Boodle launch. I love how it makes earning rewards feel fun and creative with tasks that actually encourage real engagement. The UX looks intuitive and delightful. Wishing the team great success today.

I like the idea of removing guilt from saving. It feels more realistic than strict budgets. In early testing, what helped users trust the app enough to actually change their saving behavior?