Launched this week

Binokl

Business model builder for early-stage founders.

15 followers

Business model builder for early-stage founders.

15 followers

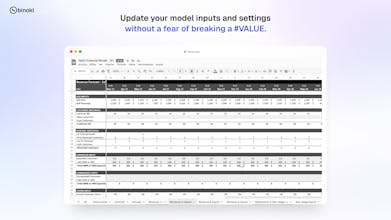

Model revenue, runway, hiring, and cash flow with a living financial model that updates as your startup evolves, not a fragile spreadsheet you’re afraid to touch.

Picking up on why Binokl exists in the first place.

This idea is personal. Every time I built or advised a startup, the same questions came up in conversations with VCs and accelerators:

– Can I bootstrap this, and for how long?

– If I raise, how much do I actually need to survive 12 months?

– Will this business make money in that time?

Most founders are great at turning ideas into products, but new to financial and business modeling. The usual path looks like this: download a financial model template, realize it’s either too generic or too opinionated, spend hours afraid to break formulas, and still end up with something that doesn’t really fit your product.

Even when you do get a model working, keeping it alive becomes a job of its own. Updating assumptions, sending versions back and forth, answering “what if we change this?” emails. Time that should go into building and selling.

Binokl keeps your model structured, understandable, and up to date, so you spend less time modeling and more time building, with confidence that the numbers actually reflect reality.

The "fragile spreadsheet you're afraid to touch" description perfectly captures early-stage founder anxiety around financial modeling. I've seen founders spend days debugging broken formulas in Excel templates that weren't built for their specific revenue model. The focus on runway, hiring, and cash flow is exactly what pre-seed founders need for VC conversations. Transparency about waitlist status during launch is appreciated. Does Binokl integrate with accounting software like QuickBooks or Xero for automated actuals, or is it primarily forward-looking projections?

@easytoolsdev

Thanks, appreciate that. You’ve described exactly the anxiety I’ve seen (and felt) myself.

Right now Binokl is primarily forward-looking by design. The core idea is to help founders reason about assumptions, runway, hiring, and funding decisions before reality forces their hand.

That said, pulling in actuals from accounting tools like QuickBooks or Xero is very much on the roadmap. The intent is not to turn Binokl into accounting software, but to let founders periodically anchor projections against reality without turning the model into a reporting system.

For early-stage teams, I’ve found the bigger problem is usually not missing data, but unclear assumptions. Binokl is deliberately optimized for that phase.

Happy to go deeper if useful.

Dear founders, I am curious,

at what point did your financial model stop helping and start becoming something you just maintained for investors?