Quoteshack

Bring the Borrower and Lender to the same page

10 followers

Bring the Borrower and Lender to the same page

10 followers

QuoteShack’s AI & ML model helps in removing fraud and fake info providers. Generating more qualified leads and making loan processing more faster and reliable. Just bringing it all-in-one place.

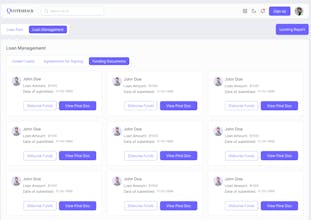

Hi, my name is Raj, co-founder of QuoteShack, this is our lender's part and it's coming soon.

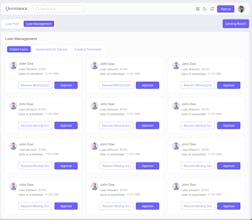

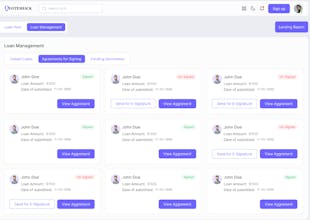

Our AI loan model will help centralize leads and convert them into loan applications, allowing you to get more done faster. Bringing everything together in one place also helps lenders finish deals faster, minimize errors, and reduce the chances of fraud and credit risks.

Problems we are working on:

Using multiple platforms by lenders in the lead generating to loan processing.

Traditional document collection system via email or links

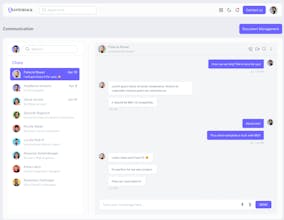

Traditional communication systems, using phones, emails, or third-party platforms for texting

Using manual or partial or no automation for errors, frauds, and risk minimization

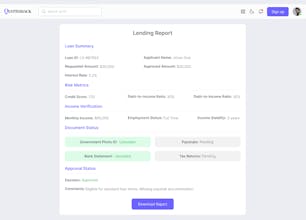

Using manual systems to verify loan applications and income

Solutions we are providing:

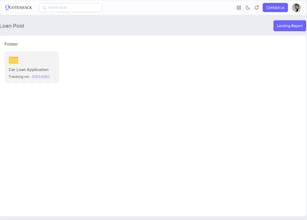

One platform to generate leads, convert them into loan applications, and process loan application

Communication channels to connect with borrowers from the same platform

Collect documents from the same platform

Analyze and verify loan applications, documents, and income from the same platform

Generate risk metrics to understand and reduce credit risk from the same platform

If any lenders or investors are interested in trying out our AI model then JOIN OUR WAITLIST