DeelFlo

AI-powered deal analysis for small business buyers

10 followers

AI-powered deal analysis for small business buyers

10 followers

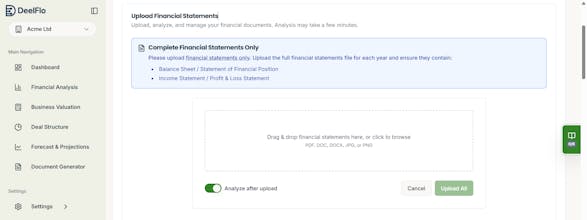

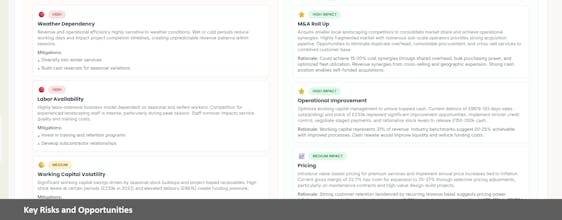

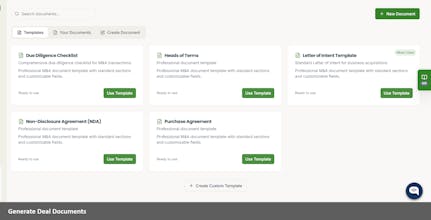

DeelFlo helps people buying small and medium-sized businesses cut the time it takes to analyse a deal. Upload a set of company accounts and get instant valuations, risk insights, financial forecasts, and structured deal terms. What normally takes hours you can do in minutes.

Automating the initial heavy lifting for SMB deal analysis is a huge value proposition. Turning hours of spreadsheet work into minutes is exactly what buyers need.

A key question on trust: How does the AI handle incomplete or "creative" accounting that's common in small business financials? Does it flag potential red flags in the data itself, or does it primarily analyze the numbers as given?

@olajiggy321 Hey Agbaje, great question. And this was the biggest challenge, because SME/SMB financials are inconsistent and there can be creative accounting. The software handles this gracefully, and rebuilds the accounts into an easy to read, consistent format. There are various complex checks that it does to ensure that the numbers make sense. We tested it extensively with different real accounts from small businesses, and it took a lot of time to get right. Let me know if you have any other questions.

@sidel

Thanks for the detailed answer—the work you've done to handle inconsistent SME accounts gracefully is exactly what gives the tool credibility.

I have a small, practical idea related to presenting that rebuilt, consistent financial data that you could try on your own.

If you're open to a suggestion, what's the best way to share it? (Email, DM, etc.)