Crawfield & Dutton

AI-Powered Financial Intelligence for the Modern Era

6 followers

AI-Powered Financial Intelligence for the Modern Era

6 followers

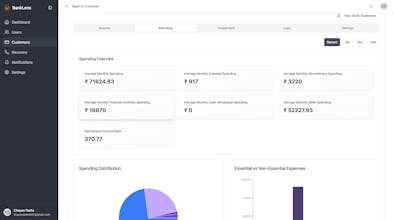

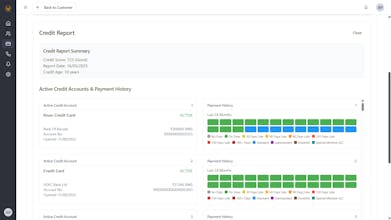

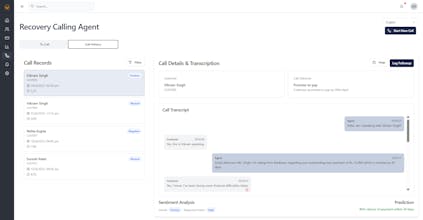

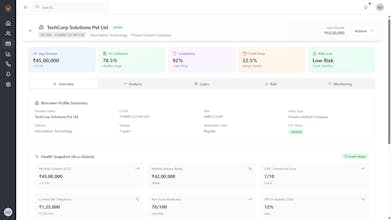

Crawfield & Dutton launched Banklens -- India’s first AI-driven loan monitoring and early-warning engine. It predicts borrower stress 30–60 days before DPD using bank data, GST, credit insights and behavioural signals. With real-time alerts, intelligent dashboards and an AI-powered collection engine, BankLens helps lenders reduce defaults and boost recovery with precision.

Free Options

Launch Team / Built With

Webflow | AI site builder — Start fast. Build right.

Start fast. Build right.

Promoted

Maker

📌Report