Launched this week

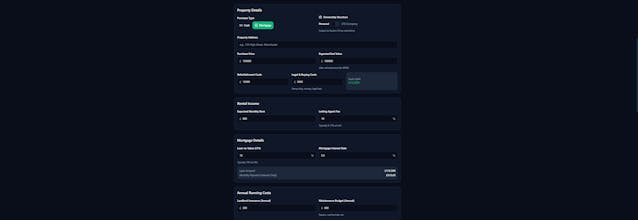

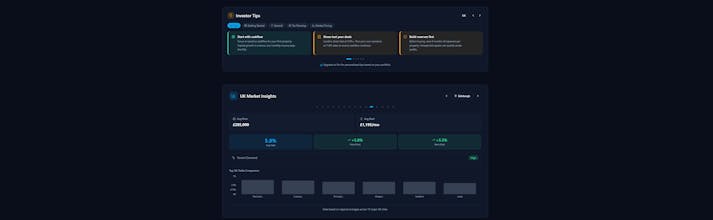

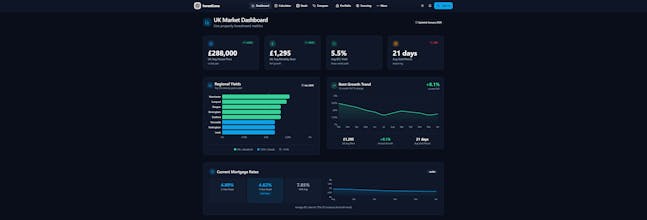

InvestLens helps property investors check if a buy-to-let deal really works before committing money. Use the calculator to see cashflow and yield, run stress tests for interest rate or void periods, and view a confidence score showing deal resilience. Built for UK investors and first-time buyers who want smarter, data-backed decisions. Early MVP -feedback welcome.