Launching today

HeyApril AI

Taxes without guesswork. AI cheat codes for what comes next.

104 followers

Taxes without guesswork. AI cheat codes for what comes next.

104 followers

Most tax tools only show up at filing time, leaving creators guessing all year. HeyApril gives you clarity while decisions are still happening. Start with a Tax Score to see where you stand, then use AI-powered strategy matching to surface tax strategies relevant to your situation. Real CPAs validate what applies, with execution available on paid plans. You stay in control. Built for creators and founders with changing income who want proactive tax planning.

👋 Hey Product Hunt, I’m Argel, founder of HeyApril AI.

Creators don’t mess up taxes because they’re careless.

They mess up because they’re guessing.

When your income changes month to month, taxes stop feeling like a once-a-year task and start feeling like background stress. Most tools only explain what happened after the year ends. Most CPAs only get involved once decisions are already locked in.

Creators and founders don’t need “better filing.”

They need clarity while decisions are happening.

Things like:

- Having a great month and still not knowing how much of it is actually yours to keep

- Saving TikTok tax tips and wondering which ones are legit and which ones could get you audited

- Paying a CPA but still feeling unsure what questions to ask without sounding clueless

- Making decisions all year and only finding out at filing time that they had tax consequences

By the time most people talk to an expert, the tax event already happened.

That’s not a discipline problem.

It’s a visibility problem.

What HeyApril does differently

HeyApril is an AI-powered tax co-pilot built for creators and founders with changing income who want clarity before filing season, not explanations after.

Instead of starting with forms, it starts with signals.

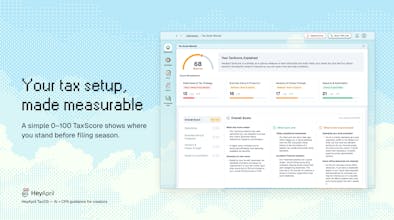

1) Tax Score

You begin with a Tax Score. It’s a simple snapshot showing where you stand and where you may be exposed.

No strategies yet. Just clarity.

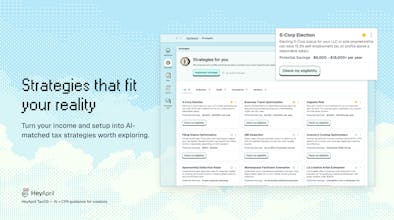

2) Strategy Matching

Next, HeyApril’s AI analyzes your profile and surfaces categories of tax strategies that may apply to your situation. This gives you early awareness so you know what’s worth exploring before it’s too late.

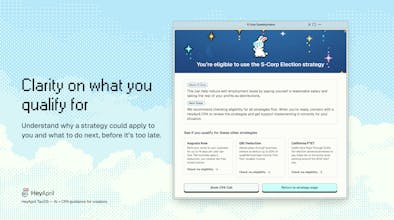

3) CPA Validation (when you want it)

When you’re ready, real CPAs validate fit and timing.

Strategy execution and ongoing maintenance are included with HeyApril Pro when you choose to move forward.

AI surfaces the signals.

Humans apply judgment.

You stay in control of every decision.

Why this isn’t TurboTax (or a replacement for CPAs)

TurboTax tells you what already happened.

HeyApril helps you understand what’s happening now.

HeyApril:

- Doesn’t auto-execute strategies

- Doesn’t promise guaranteed savings

- Doesn’t replace CPAs

- Doesn’t rely on fear or audit panic

It’s built to make tax planning feel more like checking a score than filling out a form or sitting through an awkward call.

Why I built this

I became an accountant after getting audited as a teen while juggling multiple jobs. Not because I was reckless, but because I didn’t have clarity.

That path took me to Deloitte and later to building my own practice working closely with creators and founders. Over the years, proactive tax planning helped clients save thousands per year, adding up to millions collectively.

But the same problem kept showing up.

It worked, and it didn’t scale.

The clarity always came too late.

HeyApril exists to bring that clarity earlier, without burning out teams or forcing creators into expensive advisory before they’re ready.

🎁 Product Hunt launch bonus

To get real feedback, we’re offering 2 months of free access to the HeyApril AI app.

This includes:

- Full access to the Tax Score

- The strategy matching experience

- Time to explore how the product works before committing

CPA validation and guidance are available on paid plans.

Strategy execution and ongoing maintenance are included with HeyApril Pro when you’re ready.

💬 Join the community

We’re building HeyApril in the open.

If you want to ask questions, learn with other creators, or help shape what we build next, join our Slack community here:

👉 https://heyaprilai.slack.com

We use it to:

- Share product updates

- Get early feedback on features

- Talk through real creator tax scenarios

- Learn what’s confusing, unclear, or missing

We want your feedback

If you’re a creator or founder, I’d love to hear:

- Does this make taxes feel less opaque?

- Does the Tax Score → strategy matching flow make sense?

- What would help you feel more confident throughout the year?

Thanks for checking out HeyApril.

I’ll be around in the comments 🙏

Hey Argel, awesome launch! As a developer/co-founder building apps, I’m curious if HeyApril AI is trained to identify R&D tax credit opportunities for software development costs?