Launched this week

PropIQ

Analyze any rental property in 60 seconds

18 followers

Analyze any rental property in 60 seconds

18 followers

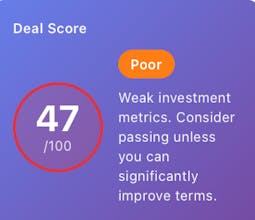

90% of first-time real estate investors never run the numbers. They fall in love with Zillow photos and end up losing $200-500/month on bad deals. PropIQ analyzes any rental property in 60 seconds: → Deal Score (0-100) → Monthly cash flow projection → Cap rate vs market average → Red flags and risks I built this after almost losing $4,000/year on a property I didn't analyze properly. Now you don't have to learn the expensive way. 3 free analyses. No credit card required.

@brian_dusape Congrats on the launch!

What information would a user need to input into the application to get the best results?

@anubhaw_mathur Great question!

To get the most accurate 'go/no-go' analysis, you only need a few basics:

• The Basics: Just the address, purchase price and expected monthly rent

• The Pro Stuff: To really dial in your Cap Rate, you can add your down payment and estimated monthly expenses

• Stress Testing: I always recommend hitting the 'Scenarios' tab to toggle interest rates or maintenance costs

It will show you 5-year projections for best and worst-case outcomes instantly

Very interesting, how effective will this tool be for properties outside of America?

@joset01656453 Great question Jose! 🌍 While our insights currently focus on the U.S. market, the core PropIQ Deal Calculator is built on universal real estate math. You can manually plug in your purchase price, expenses, and rent in any currency to get instant Cap Rate and 5-year cash flow projections. Give it a spin and let me know if it helps with your international deals!

I had a conversation with Brian, who introduced me to PropIQ. I own a rental property in Baltimore, and when he plugged in the numbers, the value of the product was immediately clear.

My wife and I had been debating whether I should sell a property I’ve owned for nearly eleven years, especially during a stressful period with the property. Using PropIQ gave us clear, objective data that helped us evaluate the investment with confidence and confirm that holding the property was the right decision.

@jeremy_babb Jeremy, I’m so glad the platform could provide that clarity for your Baltimore rental. That's exactly why we built the 3-tab engine to move past the 'gut feeling' and rely on objective data for long-term hold decisions. Appreciate the support on launch day!!

Congrats on the launching. What information you think you’ll need to input to get the best possible solution