Popsure

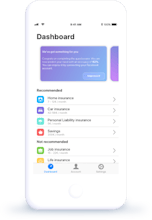

We automatically manage your insurances for you.

6 followers

We automatically manage your insurances for you.

6 followers

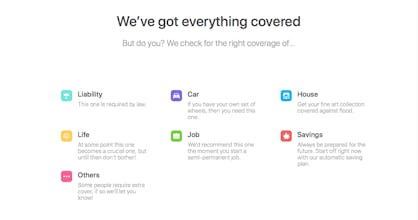

Popsure gives you insurance advice for expats in Germany. Our digital insurance agent will help you get the right insurance policies for your need.

Popsure

Popsure

Product Hunt

Popsure

Solodoers

Popsure

Solodoers

Popsure

For a digital nomad / expat such as I am, getting an insurance plan is always a pain. I'm very excited to see what Popsure will bring to the market.

Pros:Nice and clear explanation of my insurance options. For some I didn't know they even existed.

Cons:It's beta.

Solodoers

Popsure