FinFam

Collaborative financial planning with open-source expertise.

42 followers

Collaborative financial planning with open-source expertise.

42 followers

FinFam - Collaborative financial planning for friends, families, experts, and anyone else you trust. Turns Google Sheets into a GitHub for personal finance. Share your financial insights with a tight circle or the whole world. #BuildInPublic? #EarnInPublic

Hey, PH! 👋

I'm Mahmoud Hashemi, the maker of FinFam, and after a year of building, I can't believe this moment is finally here.

The Story

After 15 years building fintech at places like PayPal and Stripe, I had an epiphany. We've made money movement, investment, and banking easier than ever. But the same technology advancement has made finances harder to navigate. The open banking cf aside, the difficulty has moved up the stack: decision-making.

For the past couple years, this has gotten more personal. I’m the son of two amazing immigrant scientists, and if you know anything about academia/research you won't be surprised at their retirement plan: me. When I tried to help them decide between retiring in the USA or Canada, I was shocked. The supposed best tools turned out to be pretty generic, and we landed back on screensharing and a messy Google Sheet. Seriously.

It's even worse for non-retirement planning. Most of us have big decisions to make in the next 3-5 years, and that's a hugely underserved market. Professional advice raised more questions than answers about trust, incentives, and cost. Feels like most fintech wants to live in 2079 while financial planning is comfortably stuck in 1979. In 2025, we deserve something interactive, collaborative, creator-driven. Maybe even AI-enhanced?

Enter FinFam

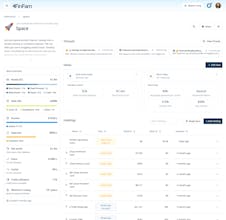

As an engineer and product lover, I wanted something that looked like Notion, and worked like the App Store meets GitHub, for financial planning. It’s a collaborative platform where friends and family can answer money questions and drive life decisions, augmented by structured expert input and AI assistance. We’ve focused on three core ideas:

🫂 Collaborative Spaces: Plan privately with your parents, share a space with your partner, or work with a trusted advisor. Like Google Docs or GitHub Repos, FinFam Spaces are private by default, and publishable by design.

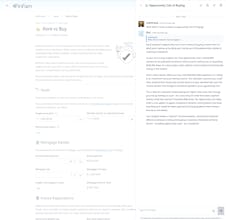

🛒 A Marketplace for Financial Insights: Lots of people claim to have insights into the market. I wanted a market of insights. Get clear answers to dozens of questions, from "Should I rent or buy?" to "Should I join a startup?", powered by open-source spreadsheets. No more AUM fee structure or appointment scheduling, just answers.

🤖 AI-assisted financial literacy: Everyone has different levels of financial literacy, especially within families and friend groups. Our AI assistant can hop in your group's chat to act as a patient, neutral guide through complex topics. Our context-driven approach ensures you get the most out of your conversations.

Let's hear it

Even though I've been working on FinFam for over a year now, I feel like I'm still at the beginning. We've got a bunch of features on the roadmap, but today I'm interested in hearing what y'all have to say!

Is anyone else here the "money person" in their friend group? My first use case was for family, but increasingly I've been helping friends out, too. So far we've used FinFam to calculate the cost of raising a kid in the bay area, deciding whether to rent or buy, and even weigh the benefits of startup vs big tech.

Any fans of The Money Diaries? We may feel fancy with #BuildInPublic but tons of folks have effectively been doing #EarnInPublic for years. The subreddit is a hoot.

Any particular personal finance decision you're facing that you'd like to see? Happy to model something.

Do you know any rising finfluencers who lean quantitative and might like to build and publish an app with our our spreadsheet-based interface? Would love to meet them!

I'll be here all day (and probably all night) to answer every single question. Let's build a future for financial planning our families can actually trust!

PS If there are any other RSS users left in the world, guess what I just added to our blog. Newsletter signup is there, too, for all you inboxers.

Might be worth mentioning:

We've just started raising an angel round

We're interviewing for frontend/design

We're also partnering with the right financial professionals

Contact info at the bottom of our About page.

I like the clean design and good use of space.

@tmtabor Thanks! Though most of the thanks should go to shadcn and huntabyte for making shadcn svelte. I'm actually on the lookout for a frontend person who can help me expose the full extent of what the backend supports. In case you know anyone :)

Tinder++

So are these your real finances?

https://finfam.app/mahmoud/space

@mfkp Give or take, yeah! I just felt obligated to lead with the dogfooding. 😅 It's probably TMI for most folks, but other users don't have to do the same. FinFam is private by default, but publishable by design. (Note: it's totally valid for others to use their spaces to model scenarios or work out hypotheticals, so not all public spaces are necessarily "real".)

Truffle

@aiymanhadi So one of our main use cases was for shopping around for mortgages. We set up our space and sent it out to three brokers to get some quick quotes. Way easier for them to see at a glance than a bunch of screenshots and PDFs. Take a look: https://finfam.app/mahmoud/space

As far as most common outcome, I just hope people feel more cooperative and financially literate. Since using it ourselves, we feel way more on top of our finances than we ever did just using budgeting tools.

Great timing! I'm about to remodel my family finances. Will give this a try.

@arsham_eslami Feel free to @ me if you need an extra pair of eyes lol