Revv Invest

Understand a stock in seconds, search for free now

373 followers

Understand a stock in seconds, search for free now

373 followers

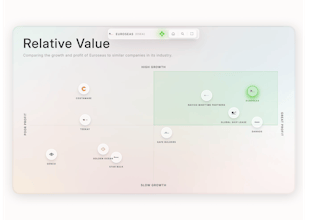

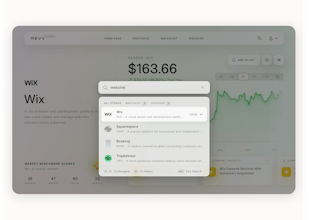

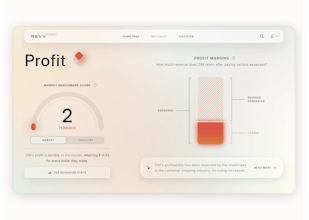

Introducing Revv, the first search engine for stocks: finding your next great investment is now ridiculously easy. Search free, accelerate your investing.

Netlify

IntroJoy

Revv Invest

Revv Invest

Floor

Revv Invest

Revv Invest

Revv Invest

Revv Invest

Revv Invest

Revv Invest

Unslack

Netlify

Revv Invest