Launched this week

Options Analysis Suite

Bloomberg Terminal for Retail Traders

1 follower

Bloomberg Terminal for Retail Traders

1 follower

Retail traders get garbage tools while institutions pay $24k/year for Bloomberg. I built the middle ground. Options Analysis Suite runs 17 pricing models (Black-Scholes, Heston, Monte Carlo, SABR, and more), calculates all 17 Greeks, and visualizes 3D volatility surfaces - all in your browser. WebGPU-accelerated Monte Carlo. Real-time data. Portfolio theory analysis. Options chain scanner with mispricing detection. 950k lines of code. Solo founder. No VC. $39/month vs $24k/year.

The Problem

Retail traders are stuck with whatever their broker gives them: basic P&L charts, maybe delta if you're lucky, and Greeks that update once a day. Meanwhile, institutions pay $24,000/year for Bloomberg terminals and license Numerix for advanced derivatives pricing.

The gap between retail and institutional tooling is absurd. You're trading the same options as hedge funds but flying blind in comparison.

What I Built

Options Analysis Suite brings institutional-caliber options analytics to your browser. No downloads, no $24k/year subscriptions, just professional-grade tools at a price retail traders can actually afford.

What Makes It Different

17 Pricing Models - Not just Black-Scholes. Price options using Heston stochastic volatility, Monte Carlo simulation, SABR, Jump Diffusion, Variance Gamma, Local Volatility, Binomial trees, FFT methods, PDE solvers, and 7 exotic option models (Barrier, Asian, Lookback, Digital, and more). Compare prices across models side-by-side.

All 17 Greeks - Delta and Gamma are just the start. Get Vanna, Charm, Vomma, Zomma, Color, Speed, Ultima, and every other sensitivity that institutions use to manage risk. Visualize how they change over time and across strikes.

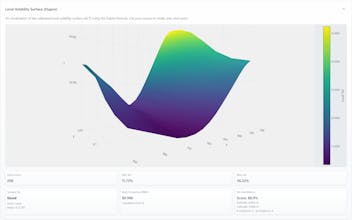

3D Volatility Surfaces - Interactive Dupire Local Volatility surfaces across strikes and expirations. Spot skew, term structure, and mispricings that flat chain views hide.

WebGPU-Accelerated Monte Carlo - Run millions of simulation paths in your browser in seconds using GPU acceleration. See full probability distributions, not just point estimates.

Portfolio Risk Management - Value at Risk (VaR), stress testing, scenario analysis, correlation matrices, and efficient frontier optimization. Know your actual risk exposure, not just your P&L.

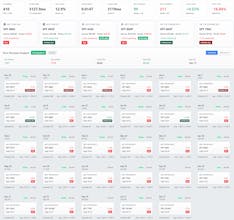

Options Chain Scanner - FFT-based mispricing detection, GEX/DEX exposure analysis, max pain calculations, probability cones, and Greeks distribution by strike. Find opportunities others miss.

Strategy Builder - 60+ pre-built strategies or build custom multi-leg positions. See payoff diagrams, aggregated Greeks, and what-if analysis before you trade. Use all 17 pricing models in your strategies.

Historical Backtesting - Test strategies against real options data going back almost two decades. Monte Carlo analysis, parameter optimization, and full performance metrics. Test your strategy against every major crisis since the 2008 financial crisis.

Real-Time Data - Live quotes, streaming options chains, and automatic Greeks updates. Not delayed, not EOD - real-time.

The Backstory

I started this for myself. I just wanted 5 basic Greek 2D lines and Black-Scholes, nothing fancy. But nothing like it existed for retail traders. So I built it. Then I needed volatility surfaces. Then more models. Then portfolio theory analysis. 950,000 lines of code and 2+ years later, here we are. No VC, no co-founders, just a trader who kept building because nothing else existed.

Everything runs in your browser. Your data stays yours. No black boxes.

Pricing

Free tier available - try everything before you pay. Pro is $39/month. That's $468/year vs Bloomberg's $24,000/year for tools that retail traders actually need.

Who It's For

Options traders who want to see what they're actually trading. Premium sellers who want real Greeks. Retail traders tired of flying blind while institutions see everything.

Bottom Line

No AI. No black boxes. Just proven Wall Street math, now in your browser for $39/month.