Launched this week

InvestBot

Investment research that explains decisions not just outputs

2 followers

Investment research that explains decisions not just outputs

2 followers

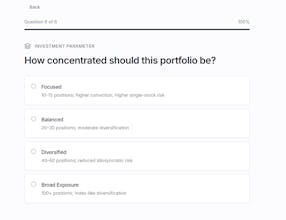

Most investment tools focus on predictions and picks. This one doesn’t. InvestBot is an investment research engine that builds portfolios based on explicit risk constraints - and tracks how they evolve over time. No signals. No forecasts. No execution. Every allocation decision is explained, and every change is tied to shifts in risk, fundamentals, or market structure. Built for investors who want to think clearly, not react emotionally.

Hey PH 👋

I built InvestBot because I wanted a calmer, more structured way to understand markets - without turning investing into a full-time job.

Happy to answer questions and would love honest feedback from the community. Thanks for checking it out 🙌

Quick update for those who were curious 👋

InvestBot has been live for two full days now.

We’re testing it on a virtual portfolio, using the stocks suggested by the system and following its structure and constraints.

I’m sharing two screenshot:

– Day 2

This is not a performance claim or a “look at the gains” post.

Two days mean nothing statistically.

What matters more to me at this stage is:

– the portfolio behaves in a controlled, understandable way

– drawdowns are explainable, not random

– every change has a clear reason behind it

That’s exactly what we’re validating right now: not prediction accuracy, but decision logic and consistency.

Still very early, still testing — but wanted to share transparently how we’re using the product ourselves.

Happy to answer questions or hear what you’d personally look at first when evaluating an investing tool like this.

An interesting and relevant service for consumers

One thing I didn’t expect while building InvestBot is how hard it is to remove features instead of adding them.

Especially when users ask for predictions or signals.

Curious if other founders here had to say "no" to popular requests to stay aligned with their core idea.