Hopscotch

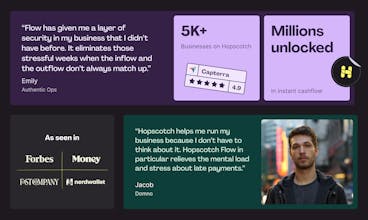

Making small businesses invincible, one invoice at a time.

452 followers

Making small businesses invincible, one invoice at a time.

452 followers

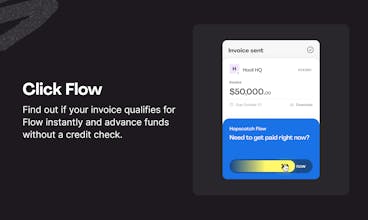

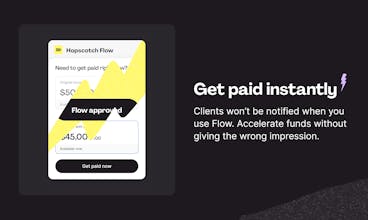

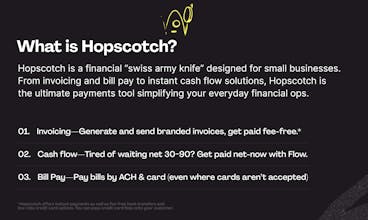

Hopscotch is the all-in-one invoicing, cash flow, and bill pay solution for small businesses. Generate and send branded invoices using our customizable templates, then use Hopscotch Flow to make sure you never get paid late again—unlock outstanding funds in just 3 clicks! Instantly accelerate funds from unpaid invoices without alerting your clients or needing a credit check.

*Hopscotch is a financial technology company, not a bank. Banking services are provided by Piermont Bank, Member FDIC.

Hopscotch

Visla

Hopscotch

INK'A

Hopscotch

Hopscotch

Unofficial Product Hunt Chrome Plugin

Hopscotch

Unofficial Product Hunt Chrome Plugin

Hopscotch

Hopscotch

Brizy

Hopscotch

Hopscotch

Hopscotch

Hopscotch

Landing Page Tools

Hopscotch

Landing Page Tools

Hopscotch