Aritect

The all-in-one platform for actionable market intelligence

114 followers

The all-in-one platform for actionable market intelligence

114 followers

Aritect is positioned at the intersection of three powerful trends: increasing information overload, increasing market fragmentation, and increasing AI capabilities, aiming to navigate the complex decentralized finance landscape.

Aritect

Hey Product Hunt!

I'm Alexander, founder of Aritect. Excited to share what we've built.

The origin story:

As a DeFi trader, I was drowning in information. Multiple chains, dozens of platforms, thousands of tokens launching daily. I missed opportunities because I couldn't process everything fast enough.

Existing tools either:

- Showed too much (information overload).

- Were too slow (opportunities gone by the time you see them).

- Didn't understand DeFi nuances (generic AI wrappers).

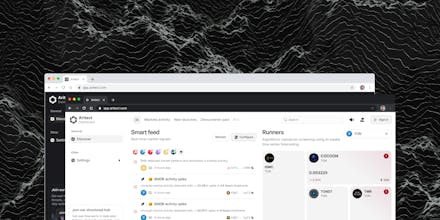

So we built Aritect - a hybrid intelligence platform that actually understands DeFi.

What we've shipped:

✅ Platform monitoring 9 chains, 30+ platforms in real-time.

✅ AI algorithms purpose-built for DeFi (not generic ChatGPT wrappers).

✅ Sub-second detection latency (200-800ms from event to alert).

✅ Telegram bots for instant notifications.

✅ Open-sourced our design system (Atomic).

What makes it work:

Our hybrid intelligence combines:

- Deterministic algorithms (reproducible, fast).

- Adaptive ML models (pattern recognition).

- Real-time data aggregation (10K-50K events/second).

Result: You get signals, not noise.

The tech behind it:

🔍 Token launch risk assessment:

Composite scoring across 8+ dimensions: liquidity health, distribution, technical index, market readiness. Every token gets a 0-100 risk score.

⚡ Arbitrage spread detection:

Real-time monitoring of CEX/DEX spreads across 14 centralized exchanges. Sub-100ms detection, automatic false positive filtering.

🤖 Market anomaly detection:

RNN-powered pattern recognition for volume spikes, transaction anomalies, and whale movements. 90%+ signal relevance rate.

📊 Multi-chain coverage:

Ethereum, Solana, BSC, TON, Polygon, Avalanche, Base, Hyperliquid, Tron.

We're building in public:

- Ecosystem page launched.

- Active community on Telegram and X.

- Multi-chain expansion shipped last week.

Recent milestones:

Week 1: Solana-only platform.

Week 2: Community feedback: "Need BSC for Chinese traders".

Week 3: Deployed 6 new chains, 9 platforms, zero downtime.

Week 4: All systems stable, signals flowing.

This is how we ship.

What's next:

We're working on:

- Automation engine (execute trades based on signals).

- Wallet tracking (follow smart money in real-time).

- Revolutionary bubble maps (completely different approach, details classified for now).

- Premium UX redesign (hiring world-class designers).

- Mobile apps (Q2 2026).

- AI trading terminal (2027).

- Enterprise white-label solutions (2027).

Try it now:

🔗 Platform: https://app.aritect.com

🌐 Ecosystem: https://aritect.com/ecosystem

Questions i'd love to answer:

- What DeFi signals matter most to you?

- What chains/platforms should we add next?

- What features would make this indispensable for your trading?

- How do you currently handle multi-chain monitoring?

Special for Product Hunt:

We're monitoring this thread closely. Ask anything about:

- Technical architecture.

- Roadmap priorities.

- Integration possibilities.

- Open source contributions.

Thanks for checking us out! Let's discuss how to make DeFi intelligence better for everyone 🚀

Cal ID

Best of luck with the launch today really cool to see this going live

Aritect

@sanskarix Really appreciate the support, thank you! 🙏🏽

It's been quite a journey getting here. Excited to see how the community responds to what we've built.

Swytchcode

Really cool concept! Aritect seems perfectly timed; cutting through the noise in a fragmented DeFi space with actionable AI signals and visual insights is precisely what traders and analysts need right now.

Aritect

@chilarai Thank you! That's exactly the problem we set out to solve 🙏🏽

Alexander - cool concept, and I for one certainly sympathize with the need to not drown in information. How do you maintain security for users, given the sensitivity of DeFi and its relatively high risk as a target for bad actors?

Aritect

Andrew Great question, and security is absolutely critical for us.

Key points on how we approach this:

1. Read-only access: We only monitor public blockchain data and DEX/CEX APIs. We never ask for private keys, seed phrases, or wallet access.

2. No custody: Users' funds stay in their wallets. We provide intelligence, not custody or trading execution.

3. Data handling: All sensitive data (API keys for exchanges, if users connect them) is encrypted at rest and in transit.

4. Risk-first approach: We don't tell you when to buy or sell. We provide comprehensive risk indicators:

- Risk scores (0-100 composite scoring).

- Liquidity health metrics.

- Token distribution analysis.

- Holder concentration data.

- Arbitrage spread detection.

The philosophy: We provide market facts. You make the decisions.

@alxshelepenok Thank you - appreciate the detailed response. Very helpful.

BeFreed

congrats on the launch!!