Payflit

The arts of payments refined

0 followers

The arts of payments refined

0 followers

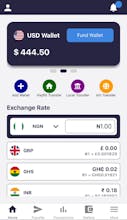

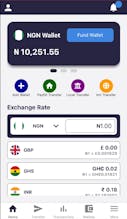

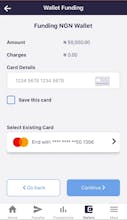

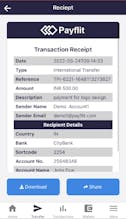

Payflit is a self service financial infrastructure that enables real time local and cross border payments to any bank or wallet using only the receiver’s account number, in both online and offline modes and for the same transaction fees and speed as local.