KYC-Chain

On-Boarding & Wallet Screening For Blockchain Companies

0 followers

On-Boarding & Wallet Screening For Blockchain Companies

0 followers

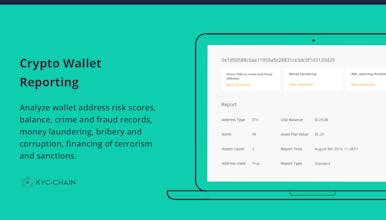

KYC-Chain helps Blockchain companies, Crypto Exchanges, ICOs, STOs & IEOs meet KYC & AML compliance by automating customer wallet screening & on-boarding

Passports.IO

Passports.IO