Knomor

Your bank’s categories are lying to you. Ours don’t.

2 followers

Your bank’s categories are lying to you. Ours don’t.

2 followers

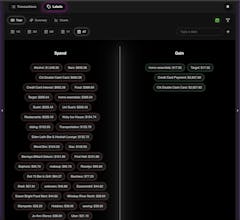

Most finance apps barely understand your transactions. They copy shallow bank categories and move on. Knomor doesn’t. We analyze every transaction in depth—pulling out meaning, context, and real patterns—so you finally see where your money actually goes. It’s personal finance built on real understanding, not generic labels.

Free Options

Launch Team / Built With

Universal-3 Pro by AssemblyAI — The first promptable speech model for production

The first promptable speech model for production

Promoted

Maker

📌Report