Edgr

A hedge fund in your pocket

9 followers

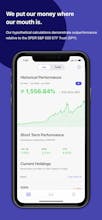

A hedge fund in your pocket

9 followers

Edgr’s algorithms sift through the regulatory filings of institutional money managers and highlights their stock investments for further research. Find hundreds of publicly disclosed stock ideas from sophisticated fund managers with successful track records.

Edgr

Edgr

Edgr

RoadGoat

Edgr