2Pi

DeFi capital markets infrastructure stack for Fintechs

3 followers

DeFi capital markets infrastructure stack for Fintechs

3 followers

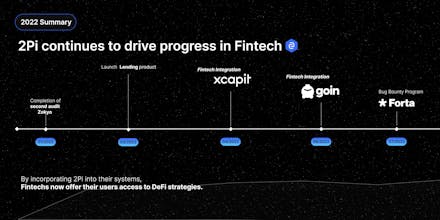

2Pi relies on blockchain technology and decentralized finances to provide the underlying structure. Fintech companies can integrate 2Pi DeFi yield white-label solutions to focus on their core and offer their customers competitive and efficient financial services.