Steady Capital

Passive income-generating commercial real estate for $100

0 followers

Passive income-generating commercial real estate for $100

0 followers

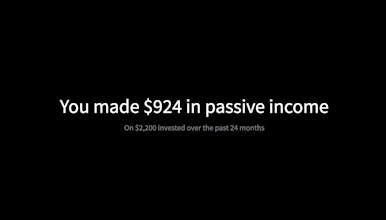

Steady Capital is a web dashboard for retail investors to buy shares of income-generating commercial real estate. Make investments and see financial reports in our dashboard, and get monthly deposits from your investments directly to your bank account.

Jib

PersistIQ

Podia