Lenmo

P2P and B2C lending platform

2 followers

P2P and B2C lending platform

2 followers

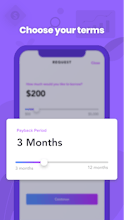

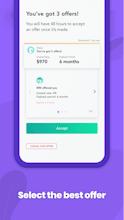

Lenmo is a peer-to-peer lending app that connects people looking to borrow money with people looking to make money. Looking to make some money? You don’t need to be a financial expert - making investment decisions is easy through the app.

Baserow

Lenmo

Baserow

FlowFinitee

It is the simply the uber for lending, a solution like this has been needed for a long time and it is so simple to get setup, to interact. Even from a lender perspective, it is great as it is secure, borrowers are vetted and they can start small to test it out as the team give you credit to play with so gain even more trust!

Pros:I love Lenmo as it is an easy simple way to get quick access to cash, there's no middle man and the UX is simply awesome.

Cons:I don't see any for now.

I signed up for Lenmo with one email address. Their app wasn’t working properly, so I could not enter my home address without being kicked out of the app. Once they fixed that, I couldn’t sign back into the app. So, I signed up with a different email address. I was able to enter my regular address in this time, but now it said my SSN was already being used. So, I opened up a support ticket. It took a week for them to reply and when they did, it wasn’t helpful. So I’d ask another question and another week goes by and another unhelpful answer. This went on and on for WEEKS. They say for the security of MY account, I cannot sign up for a new account because my SSN is linked to the other account. But I can’t access that account because it tells me that first account DOESN’T EXIST. On top of all that, the last time they answered me, they attached another user’s NAME, ADDRESS, and PAY STUB to MY answer which I could easily access and read. After about two months of going back and forth, it was decided that I could never use the app. So I never got to and I never will. I just hope they don’t attach my private information to someone else’s question.

Pros:There are none that I’ve found so far.

Cons:Customer service stinks. You have to HUNT for a phone number and the number doesn’t work.

Baserow

It's not very ROI+ for the risk you take on. If you were able to set your own rates, this would be properly executed.

Pros:-Good UI -Serves market purpose

Cons:-Extremely low returns for the risk -Inability to set your own rates (as a lender)

Lenmo

I attempted to create a borrower profile and kept on running into issues. I escalated the problem multiple times and it was never resolved.

Pros:It's a great concept

Cons:Horrible execution and complete lack of support