Fundverse

Raise capital with ease, Manage portfolio startups with ease

2 followers

Raise capital with ease, Manage portfolio startups with ease

2 followers

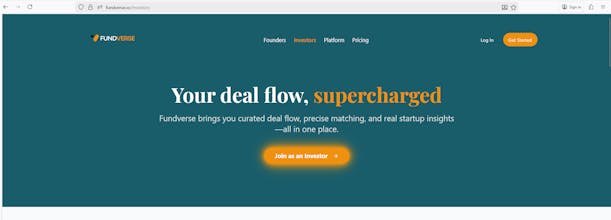

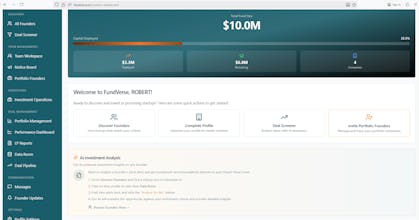

Managing deal flow manually is becoming impossible. Learn why sophisticated investors are adopting specialized software to stay competitive.

Interactive

Free Options

Launch Team / Built With