Fast409A

The fast, easy way to get a 409A valuation.

2 followers

The fast, easy way to get a 409A valuation.

2 followers

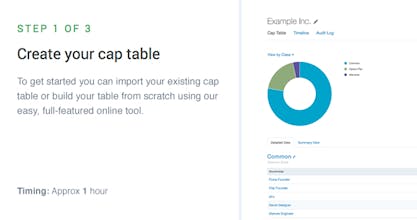

The Fast409A process blends the best of software and human expertise. Each valuation takes an hour or less of your time to submit, is delivered in days not weeks, and is customized to the nuances of your individual startup.

Fast409A

Fast409A

Fast409A

Fast409A

Product Hunt

Business Dad with Alexis Ohanian

Plaid

Fast409A

followupthen

Fast409A

Wealthfront

Fast409A

Zube

Fast409A