DealSpark

M&A deal management for SMB Buyers and Search Entrepreneurs

2 followers

M&A deal management for SMB Buyers and Search Entrepreneurs

2 followers

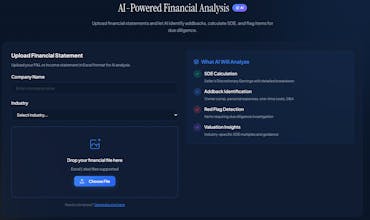

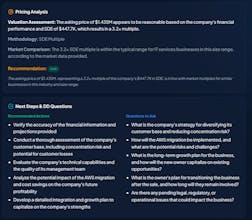

DealSpark streamlines your entire M&A workflow. Track deals in a visual pipeline, analyze financials with AI-powered addback suggestions, generate LOIs, SBA calculator, and manage due diligence with red flag reports, AI CIM generators, and diligence request lists — all in one platform. Built by acquirers, for acquirers. These are the same tools used to help build a national rollup across hundreds of M&A deals.

Free Options

Launch Team / Built With

AssemblyAI — Build voice AI apps with a single API

Build voice AI apps with a single API

Promoted

Maker

📌Report