BestYieldFinder

Real estate investments made simple.

25 followers

Real estate investments made simple.

25 followers

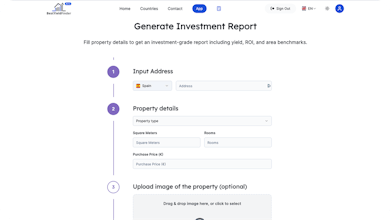

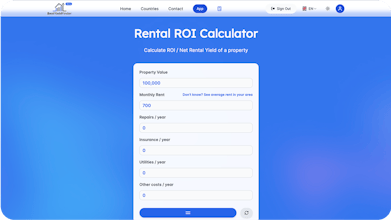

BestYieldFinder helps real estate investors make smarter, faster decisions. Analyze rental yields, price trends, and market dynamics across Europe to find the most profitable opportunities, backed by clear, data‑driven insights.

Smoopit

Great work on developing this platform. I am curious about how you ensure the accuracy and timeliness of the data across different markets. Do you have specific data sources or validation processes in place @artur_cherkanov

@rachitmagon Thank you! Great question.

To ensure the accuracy and timeliness of yield data across markets, we use a combination of trusted on-chain data sources and real-time indexing. Most of our data is pulled directly from smart contracts or reliable protocol APIs, which reduces the risk of outdated or manipulated information.

We also run our own validation layer that checks for anomalies—like sudden spikes or drops in APYs—and flags them for review. If there's any downtime or desync on a source, we failover to backup endpoints or temporarily exclude that protocol from results.

Maintaining data integrity is critical to what we do, so this part of the system is constantly monitored and improving. Appreciate your interest!

Smoopit

@artur_cherkanov Thanks for the thorough explanation. Sounds solid.