Launching today

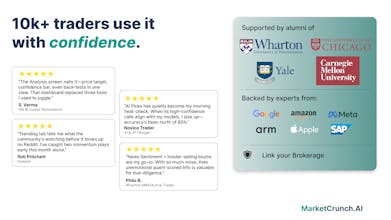

Most “AI stock research” tools are dressed-up ChatGPTs, or worse, hallucinating bots. At MarketCrunch AI, we built a deep-learning quantitative AI model that analyzes 300 million+ points daily - including macro, price action, news - to give you 1-click next-day + weekly price targets. Our AI shows its work: each price target has confidence markers, backtest, and clear drivers to help you can decide on trade / size / skip. Our fans say, its Bloomberg terminal for Robinhood users.

Hi! I'm founder & CEO of MarketCrunch AI and @ashim_datta2 (CTO) and I are super excited to share an update.

Most “AI stock research tools” feel like screeners, or worse hallucinating bots!

We built MarketCrunch AI ground up using a proprietary Deep AI model to crunch large numerical set. Not your run-of-the-mill LLM/language model, which we believe can't reliably process numbers or worse hallunicates!

We help you be more disciplined traders with: next-day + weekly price targets with confidence, backtest context, and a clear explanation, so you can decide on trade / size / skip.

Who it’s for: Pro retail traders and/accredited investors to complement their research with unique quant-based insights.

What you’ll see inside:

✅ Next-day + weekly price targets with hit-rate, backtest, technicals, and confidence level - in plain English

✅ Suggested Options based on our price target and a tool to explore strike-price + days-to-expiry

✅ AI-picks published ~5PM PT everyday by our model (no human review)

✅ Pulse: scans 2000 stocks across scores of indicators during Market open so you don't have to.

✅ Free emails alerting for 'Breakouts' with option to add watchlist and alerts.

What I’d love feedback on:

❓ Does the confidence + evidence make it easier to act responsibly (or to skip a trade)?

❓ What’s unclear, missing, or feels like “black box” hand-waving?

Note: This is research tooling, not investment advice. If you reply with a ticker you follow + your time horizon, I’ll help interpret what you’re seeing.

@ashim_datta2 @bhushan_s When do you plan to cover data beyond US stocks

Tried MarketCrunch AI on $AMZN. What clicked: it doesn't just spit a number—there's confidence + context so I can decide 'trade / size / skip.' Curious how you think about calibration over time

@shaurya_prakaash — sharing two posts on how we think about confidence and calibration:

https://marketcrunch.ai/blog/stock-price-forecasts-approaching-uncertainty-with-deep-ml

Note: confidence doesn’t automatically mean “accurate.” In our analysis reports it mostly reflects how tight the forecast range is (i.e., uncertainty)—kind of like “20% chance of rain” means rain is possible, but uncertain. That said, we show in the blog post that forecasts tend to be more accurate at the very highest confidence levels.

https://marketcrunch.ai/blog/many-models-one-signal-how-ensemble-calibration-improves-stock-price-estimates

We use ensemble calibration to keep learning from past errors, so as we make more predictions, the system improves over time.

I’m usually skeptical of AI forecasts because they’re marketed like guarantees. I like that you’re framing it as uncertainty + scenarios. What guardrails do you have to prevent people from over-trusting the target?