Polygon: Scaling Ethereum to the masses

A complete analysis of Polygon

Polygon is probably the most ambitious startup I’ve ever written about.

Ethereum users were facing a problem, so they decided to solve it.

But solving just one problem wasn’t good enough for them.

They decided to tackle a bigger challenge: scaling Ethereum to the masses.

Along the way, they picked up star investors like Mark Cuban and Balaji Srinivasan and became an $11 billion startup.

In today’s newsletter, I’ll breakdown this amazing startup:

- The Story of Polygon

- What problem is Polygon solving?

- How big is this problem?

- How is Polygon solving this problem?

- How will Polygon make money by solving this problem?

Let’s go🚀🚀

🕹️The Story of Polygon:

Jaynti Kanani’s childhood was defined by poverty. His father was a diamond factory worker, and they lived in a small house on the outskirts of Ahmedabad.

His father had to take a loan because he couldn’t afford to pay Jaynti’s school fees. The situation became worse when his father fell ill and slowly started to lose his vision, and had to retire early from the factory.

Somehow, Jaynti managed to pass class 10th and 12th, and got admission to Dharamsinh Desai University in Nadiad for engineering.

His only goal during college was to get a good job so that he could pay off his father’s debt.

So he applied to big companies like Twitter, Stripe, etc but he was always rejected. His first job was at Persistent Systems in Pune at a salary of Rs. 6000 a month. After that, he got a data science job in Housing dot com.

But his dream was to do something of his own.

In 2017, Game of Thrones had become very popular. So he started making a website where people would bet which character would die in the next episode.

But there was a problem: according to Indian finance rules, he had to clear a lot of legal hurdles to add a payment feature on the website.

So he started looking for alternative payment solutions. That’s when he came across crypto.

He was fascinated by the world of crypto: Ethereum, defi, nft, etc

At that time, the Ethereum network was under heavy load because of the wildly popular app CryptoKitties. Doing transactions on Ethereum had become very expensive and very slow.

That’s when Jaynti had the 11 billion dollar idea: a platform to make Ethereum faster and cheaper.

He got in touch with his friends Sandeep Nailwal and Anurag Arjun, and they started working on this idea. Later, Serbian engineer Mihalio Jelic joined the team.

They called it: MATIC.

Initially, investors refused to fund MATIC because crypto had such a negative image. But he didn’t give up. He and his teammates raised money from friends and family to keep Matic alive.

In 2019, MATIC was officially launched through an initial exchange offering on Binance, in which the team got $5 million funding.

But more importantly, they got developer attention. Developers were amazed to see MATIC’s performance: 4000x faster and 10,000 times cheaper than Ethereum!

Big web3 projects like OpenSea and Decentraland started coming on MATIC. Superstar investors like Mark Cuban and Balaji Srinivasan invested in Matic.

On February 9th of 2021, MATIC rebranded to Polygon.

Today, Polygon has 135 million users, and it is sitting at a valuation of $11 billion!!

🕹️What problem is Polygon solving?

Ethereum is awesome. Really awesome. But the problem is: Ethereum can’t handle this awesomeness.

I'll explain why.

See, Ethereum is like a giant computer.

Whenever you want to do a transaction on Ethereum, it uses computer energy to complete the transaction.

Spending computer energy needs money.

Ethereum takes this money from users. It’s called gas fees.

All transactions on Ethereum require gas fees.

But remember: Ethereum is still a computer. And every computer has its limits.

Ethereum's limit is that it can only handle 15 transactions in one second. But there are a hundred million users on Ethereum.

You know what this means, right? A loooooong line of users waiting for their transactions to get completed.

But Ethereum has a feature in which users can pay more gas fees and jump the long line and get their transactions completed first.

MorningBrew has a good explanation:

Gas fees don’t denote actual liquid fuel consumption or environmental impact, they’re more like a “tip” that you’d slide a bouncer to cut the line for a club. In this analogy, the bouncer is an Ethereum miner, the club is a completed block of transactions, and the line is a bunch of eager nerds hoping to get in before Snoop Dogg comes on.

The result: People pay more and more money to complete their transactions first and gas fees go to the moon.

CryptoKitties is a good example. This game became so popular that it jammed up Ethereum and transactions were taking hours and days and cost a pile.

Another example is ConstitutionDAO: Members contributed to the DAO to buy the constitution, but it failed, and then spent more than an estimated $1 million on gas fees to retrieve their contributions!

You see the problem, right? Doing transactions on Ethereum is very slow and very expensive.

🕹️How big is this problem?

Currently, there are close to 100 million Ethereum users. They pay an average of $46 in gas fees. And they wait for 10-20 seconds to complete their transactions.

This means every single one of these 100 million users is facing the Ethereum problem.

But the problem isn’t limited to just 100 million users.

Everyone in the crypto world knows Ethereum is going to a billion users.

Web3 is the future, and Ethereum will pull these billion people into the future.

Now imagine a person among these next billion. He has heard a lot about crypto and web3, and he is full of hopes and dreams about this new world.

He logs onto Ethereum, tries to do a transaction and what does he find?

$100 gas fees for a simple transaction? And a waiting time of several minutes?

Is this the future he imagined? Full of gas fees and long waiting times?

Nope.

What will he do when he sees this shitshow? He will log out of Ethereum and go back to web2.

Along with him, the remaining billion users who were supposed to come to web3 will go back to web2. web3 dream over. bye.

This is how big the problem is: A billion users.

🕹️How is Polygon solving this problem?

Polygon solved the “Ethereum is slow and expensive” problem by adding a new blockchain on top of Ethereum.

They call this new blockchain "Polygon POS: The easiest way to scale your Ethereum app".

It solves both problems of Ethereum: slow speed, and high gas fees.

Here's how it works:

- I am a web3 developer. I have made an app on Ethereum called Integral.

- But I'm frustrated. Because Ethereum is slow, my app is slow. Because using Ethereum is expensive, using my app is expensive.

- Then, I hear about Polygon's fast and cheap transactions, and I'm amazed. I decide to immediately shift to Polygon.

- Now, suppose one of my subscribers on Ethereum comes to use my app.

- At first glance, the app looks exactly the same as last time to him. But when he does a transaction on the app, boom! It’s superfast and supercheap! He is amazed!

- The magic has happened behind the scenes.

- When my subscriber on Ethereum does a transaction on my app, it will go to a special place on Ethereum called MATIC Deposit Manager.

- From the MATIC Deposit Manager, it gets on a Plasma bridge and goes straight to the Polygon blockchain.

- Once it has reached the world of Polygon, gas fees and slow speed is gone. The transaction takes place quickly and with minimal gas fees.

- After the transaction takes place on Polygon, it is committed on a Polygon block.

- On Polygon, the block producers are quickly producing blocks for the polygon blockchain. To commit these newly produced polygon blocks to Ethereum, Polygon uses Proof of Stake.

- After every few blocks, a polygon guy will select a checkpoint on polygon's ethereum chain. Everyone on polygon will then vote on this checkpoint. if 2/3rd of polygon people vote in favor, the checkpoint is printed onto polygon’s Ethereum layer. People on the real Ethereum can challenge this checkpoint for some period of time. If no one does, the checkpoint is final. From polygon's Ethereum layer, it goes to the real Ethereum.

The result? Transactions on Polygon get cleared after 1-2 seconds, as against 15-20 seconds on Ethereum. Gas fees are a thousand times cheaper than Ethereum, between $0.00004-$0.00012. And Polygon is 4000x faster than Ethereum: it can process 65,000 transactions per second!

What I just told you is one way of solving the Ethereum problem. But there are other ways as well.

- Rollups: Uniswap does this. It doesn’t process 1000 Uniswap transactions on Ethereum. Instead, it rolls them up in a bundle and sends them to a rollup and submits the results back to Ethereum. This is also cheap and quick. Polygon didn’t want to be left behind in the race, so it is also launching many rollup products, like Hermez, Miden, Nightfall, Zero.

- L1s: They are whole new blockchains that want to replace Ethereum. L1’s like Solana are completely separate from Ethereum. But many L1s like Binance Smart Chain make themselves Ethereum-compatible, to attract users and developers. Polygon has attacked this market also. They have made a product called Polygon Edge which helps developers build Ethereum-compatible blockchains.

After reading about all these products, I realized Polygon's ambition. They don't want to solve the Ethereum problem in one way. They want to solve it in every way possible.

Why?

Because they believe that, in the future, users will only interact with Polygon. Polygon will handle the transactions. Ethereum will only be used for committing transactions. Basically, Ethereum will serve Polygon and Polygon will serve users.

Sounds awesome, right?

The only problem I can see is security.

According to independent security analysis of Polygon’s PoS bridge:

Through our examination of the contract code, the owner of the contract can upgrade and replace the contract at any time (without a delay period), which means that the owner can withdraw all user assets in the contract at any time, which is certainly a potential security risk. Therefore, the assets transferred to the Polygon chain through the PoS Bridge are not trustless at this stage.

Also, the Polygon PoS bridge is controlled by a wallet. This wallet has 8 signatories, out of which 4 are Polygon co-founders, and the remaining are key members from Polygon Defi projects.

🕹️How will Polygon make money by solving this problem?

Polygon makes money through gas fees.

More users will use Polygon. More users will do more transactions on Polygon. More transactions will pay more gas fees to Polygon. More gas fees for Polygon means more revenue.

Let’s see how Polygon is doing on each front.

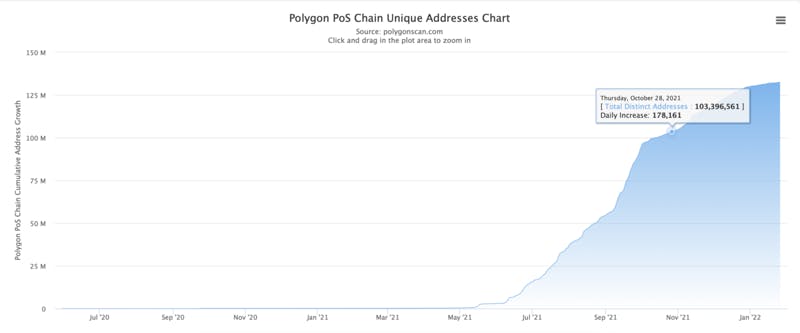

1. More users are coming to Polygon:

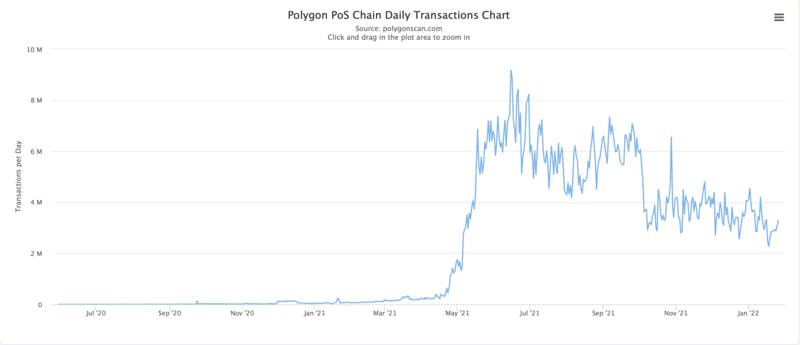

2. More users will do more transactions on Polygon:

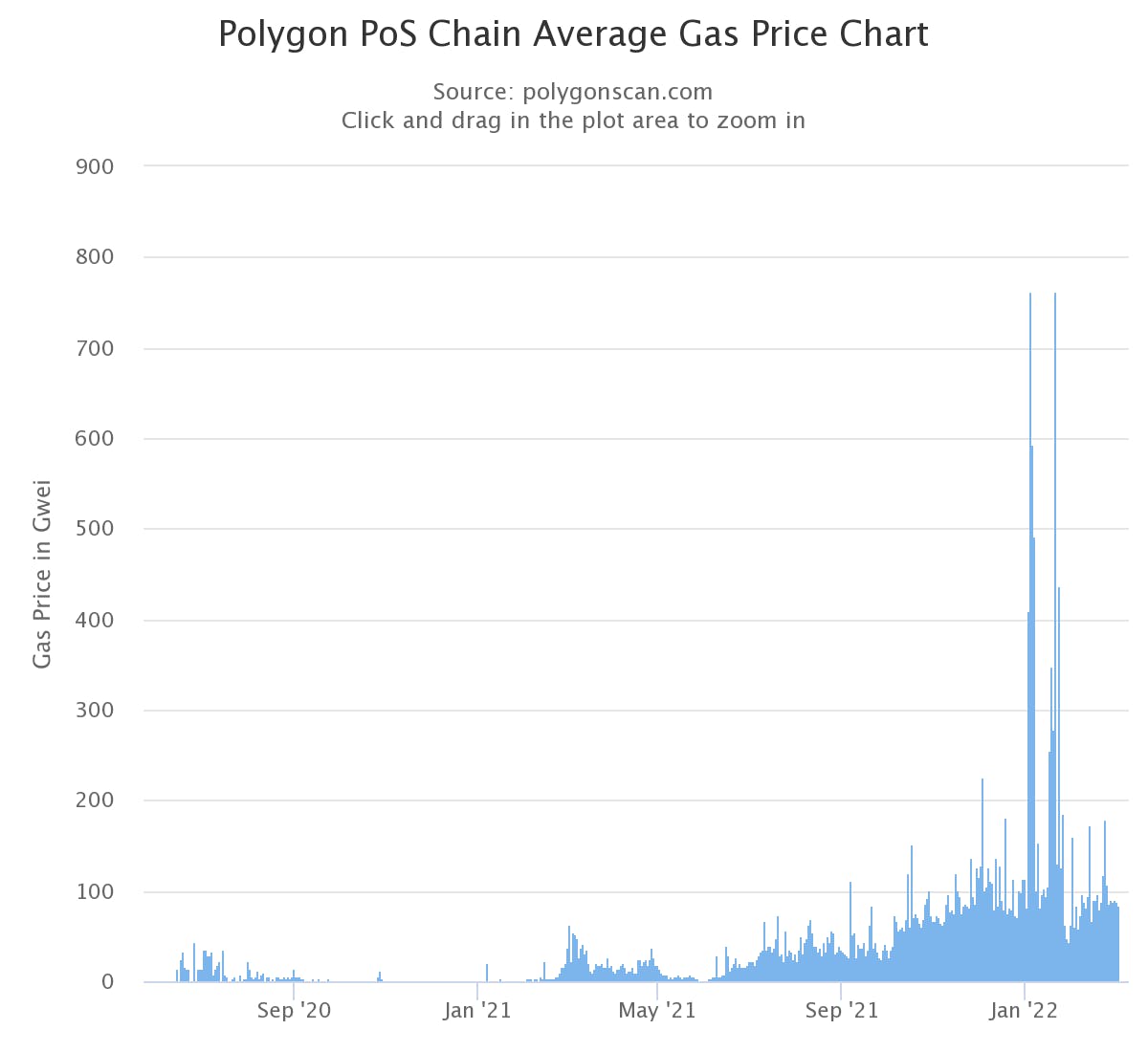

3. More transactions will bring more gas fees to Polygon:

The result: daily revenue grew 92% week-on-week!

By looking at the news, it seems as if this growth will only go up in the future:

- Big web3 projects like OpenSea and Decentraland and Aave use Polygon.

- Polygon has also launched Polygon Studio, committing $100 million to gaming and NFT projects.

- Recently, Polygon partnered with Infosys to launch M-Setu: an open-source bridge for companies to operate through Ethereum.

- Mark Cuban and Balaji Srinivasan have invested in the startup.

- There are 135 million+ Polygon addresses. 5 million daily transactions. 76 million total transactions. 7000+ Polygon dapps. 2 million Polygon NFTs sold.

- According to a dashboard on Dune Analytics, Polygon’s bridges hold $6.6 billion in total value locked (TVL)

–

This article originally appeared in Integral, a newsletter to get smarter about Indian startups.

Comments (4)

Laustov@louise_liu

This is such an amazing article that solved my question for a loooong time! Thanks for the research and I have already subscribed your newsletter. Cheers.

Share

v helpful article, thank you for putting it together. I'd swap some of the 'he' in the examples with 'she' & 'they'

This is a centralised garbage. Not much different from any other btc or eth sidechain.

More stories

Keegan Walden · Makers · 7 min read

The inner work of startup building

Calvin Chen · Makers · 7 min read

Suffering = Growth

Sumanyu Sharma · News · 4 min read

Can LLMs find bugs in large codebases?

Sarah Wright · News · 3 min read

What AI tech leaders say about AGI