Is play to earn gaming a Ponzi scheme?

Some of my fondest memories are from gaming - killing demons in Diablo, traveling through time in Chrono Trigger, and fighting space battles in Starcraft.

Peter Yang is passionate about helping people make a living doing what they love online. He's worked on creator growth at Twitch, Facebook, and Twitter and wrote a best-selling book on product management. He also creates web3 education at Odyssey DAO and is a PM at Reddit. Find him on Twitter.

As a lifelong gamer, I’ve often lamented as mobile gaming’s rise came with a focus on monetization at the sacrifice of fun.

I’m not alone. Diablo Immortal got an all-time low Metacritic score of 0.4 thanks to its pay-to-win mechanics. This brings us to the latest monetization trend: Play to earn.

Play to earn lets players earn in-game items in the form of NFTs and tokens that they can then cash out for real-world profit. Millions of dollars have been poured into play to earn games and top publishers like Ubisoft and Square Enix are jumping aboard.

But is play to earn here to stay or is it a Ponzi scheme?

What is play to earn?

Here’s how play to earn works:

- You need to buy an NFT to play the game.

- You earn in-game items in the form of NFTs and tokens as you play.

- You can reinvest these tokens into the game or cash them out for a profit.

Let’s cover the bull and bear case for this new model:

- Bull case: Play to earn can help millions of people make a living. Since you earn in-game items as NFTs and tokens, you can easily bring them to another game or sell them for real-world profit.

- Bear case: Play to earn is a Ponzi scheme. The in-game items that you earn have no intrinsic value. The only way that you can make a profit is to sell these items to unsuspecting new players before demand falls off.

So which case is the reality? Let’s take a look at two popular play to earn apps - Axie Infinity and STEPN.

The rise and fall of Axie Infinity

Axie Infinity is a game where you battle digital pets:

- You need to buy or rent 3 Axies from another player to play the game.

- You earn Smooth Love Potion (SLP) tokens as you win battles.

- You can reinvest your SLP tokens to breed new Axies or cash them out for another cryptocurrency. You can also rent or sell your Axies to another player.

People primarily play Axie to make money. There are two customer segments:

- Investors buy Axies that they can rent to a scholar.

- Scholars play the game to earn SLP tokens that investors get a cut of.

Axie Infinity’s developer, Sky Mavis, also gets a 4.25% cut of all transactions.

So how is the game doing? Here’s the bull and bear case:

- Bull case: Axie Infinity has helped thousands of players make a living (40% of players were from the Phillipines). In late 2021, the company raised $160M from top investors and had 2M daily users.

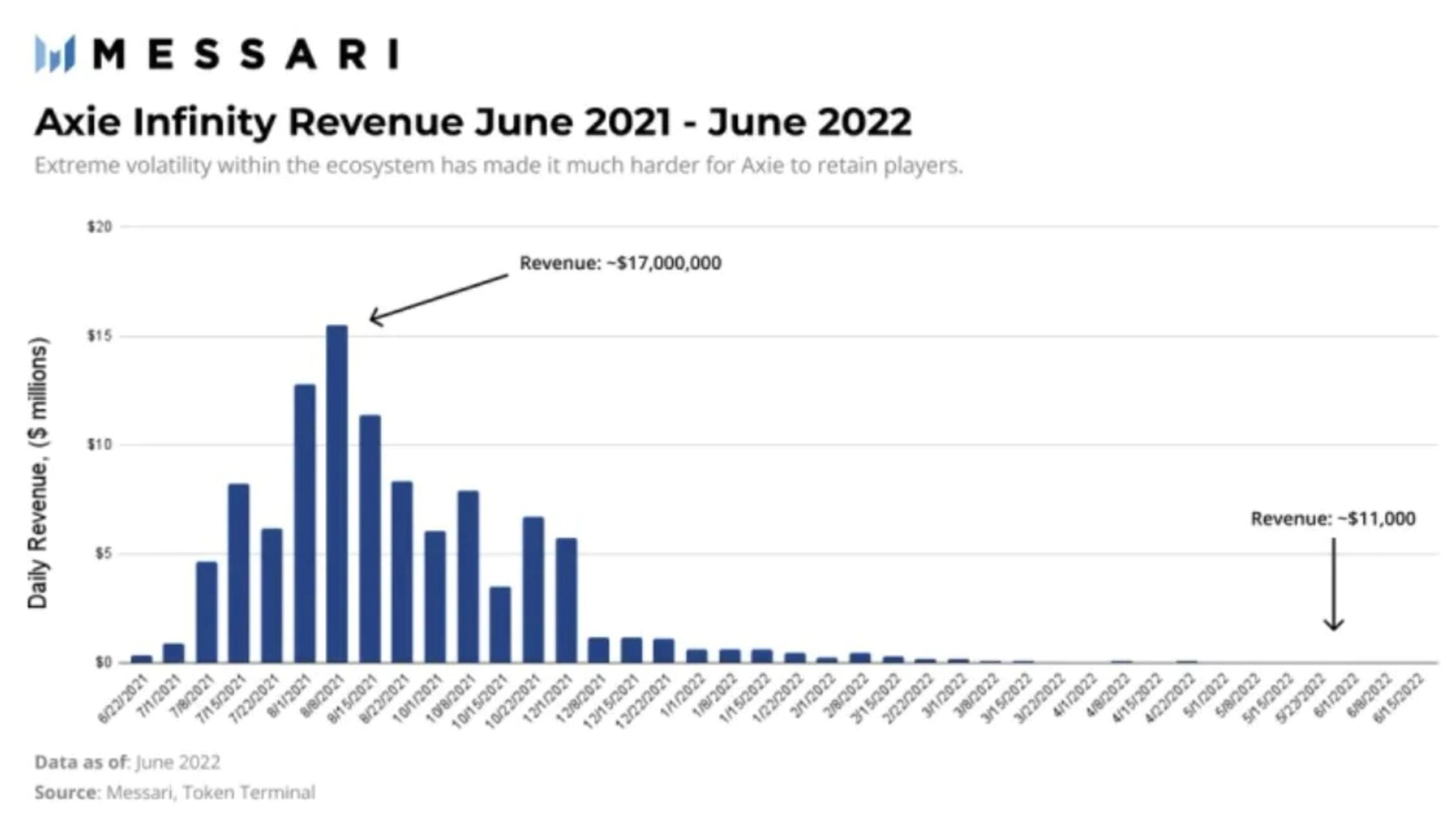

- Bear case: Axie Infinity has seen a dramatic decline in both daily users (-60% year to date) and SLP token price (-86%). This decline is likely due to fewer new players buying Axies, leading existing players to quit and cash out.

Here’s the core problem with Axie:

If people are playing to make money, they will quit the minute the money stops.

That’s essentially what Axie has experienced (a recent $650M hack didn’t help):

The Axie team is working on a free to play version of the game along with other efforts, but it’s unclear if players will come back.

Axie Infinity revenue. Source: Kel (Messari)

Can STEPN avoid the same fate?

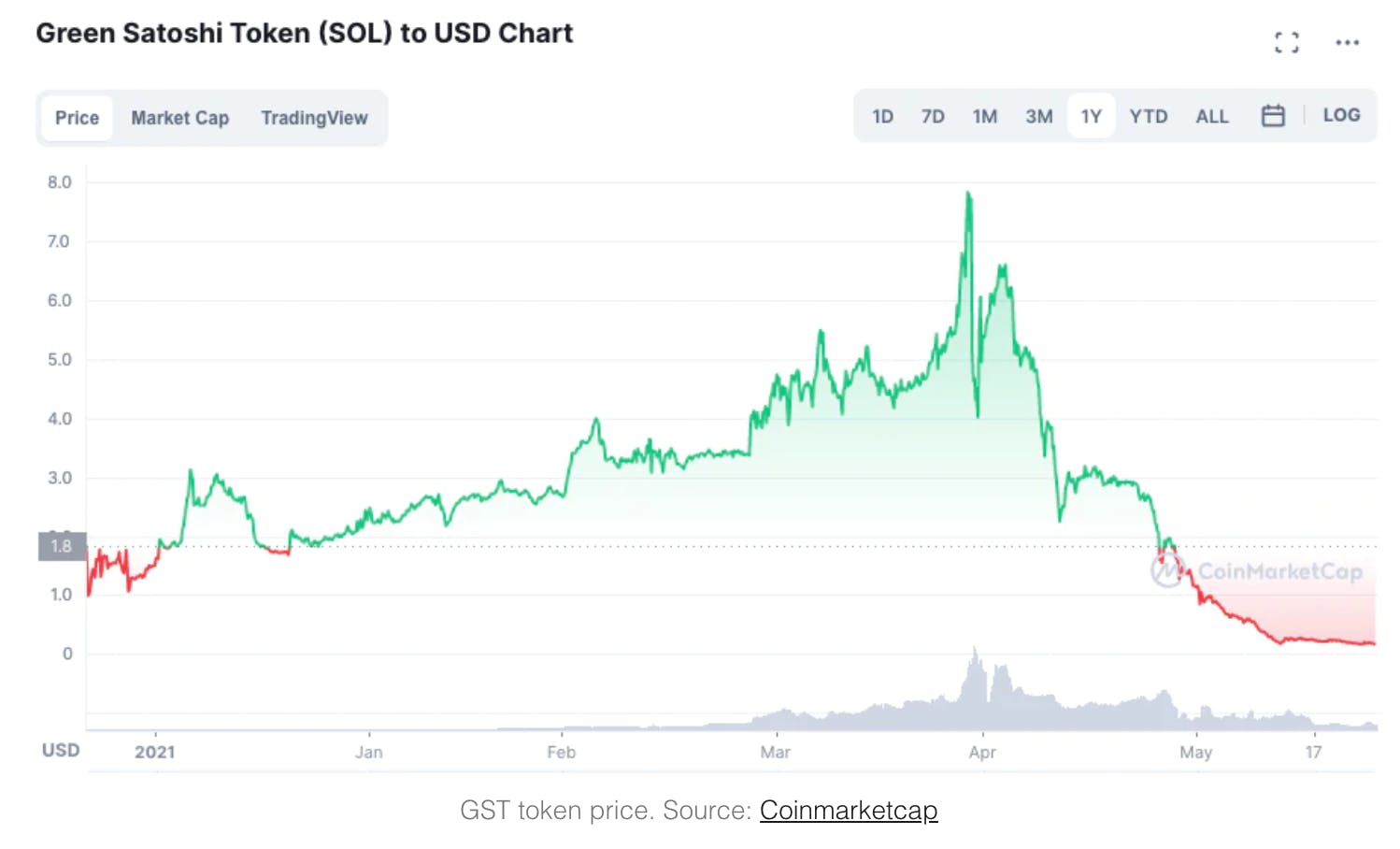

A token economy relies on supply and demand. As we’ve seen from Axie, a play to earn game’s token price craters when:

- Token demand drops due to fewer new players.

- Token supply increases due to existing players cashing out their tokens (increases supply) instead of re-investing them into the game (reduces supply).

STEPN is the latest play to earn game to capture people’s attention, reaching 3M active users in record time. Dubbed “move to earn,” STEPN works as follows:

- You need to buy a virtual NFT sneaker to play.

- You earn GST, STEPN’s game token, by walking or running outside.

- You can reinvest your GST tokens to mint new sneakers or cash out GST for another cryptocurrency. You can also rent or sell your sneakers to another player for a profit.

So far, this sounds very similar to Axie, except you need to walk outside to earn tokens instead of battling virtual pets. What I find interesting is that the STEPN team actually published a post called “Are all play-to-earn games Ponzi?” back in April.

This post shows that the STEPN team is very aware of play to earn’s pitfalls. To maintain the token economy, the’ve taken steps to:

- Reduce token supply by giving people more ways to reinvest their tokens in the game (e.g., upgrade NFT shoes).

- Increase token demand by limiting how many new players can join via activation codes.

Nevertheless, GST token price has cratered (ironically shortly after STEPN published the post in April):

GST token price. Source: Coinmarketcap

And users have also declined by 50%:

The STEPN team discovered that:

If people are playing to make money, they will be more motivated to cheat.

The team is already spending nearly half of its resources to fight cheaters who are faking motion data.

Is play to earn here to stay?

So is play to earn a Ponzi? Let’s be honest:

- It’s hard to make a game that’s fun.

- It’s REALLY hard to make a game that’s fun AND helps you make money.

Very few games can achieve #2 because fun and money are usually at the opposite ends of the gaming spectrum (poker is a good exception).

I think play to earn today is more Ponzi than not. The play to earn games that I’ve tried feel more like DeFi protocols with a game UI than actual games. For web3 gaming to be sustainable, I think we need to see:

- A focus on fun first. People must be intrinsically motivated to play the game because it’s fun.

- A token economy that doesn’t hurt #2. NFTs and tokens should enhance the core fun loop. Fortnite prints money because it lets people pay to customize their in-game character and items without impacting the balance of the game.

- NFTs that provide real utility. For example, if the NFTs or tokens that you earn were usable across multiple games, you’ll be less likely to cash out.

Let’s use a hypothetical Diablo online game to imagine how this might work:

- You form a team with other players to beat Lilith, a special endgame boss that only appears once every few months. You get lucky and win a legendary sword NFT for your effort (1 of 1,000).

- Your sword NFT has the same stats as a regular endgame sword but comes with an unique appearance that makes your character look much cooler.

- A few months later, you and other holders of this sword NFT get access to a special in-game event. You also get backstage access to meet the devs at the next BlizzCon.

- Since the sword NFT has actual utility, it increases in value and you can sell it for a profit if you want to.

This is how I think games can integrate NFTs without pissing people off.

It’s less “play to earn” and more “play to have fun and unlock some NFTs that have real utility and value.”

Less catchy for sure, but also less Ponzi.

Comments (7)

Lahiri 'Lam' Abdalla@lahiri_abdalla

Couldn't agree more, Peter. I wrote an article about this on HackerNoon last month, comparing Epic and Valve perspective on skins and how the adoption of web3 tendencies by huge companies like them could be an interesting short-term solution to P2E while the category as a whole does not set themselves as a real gaming method.

At this point in time, P2E games are not necessarily scams, but they always seems a bit shady and unsure of what to do. I think right now they should be more games and less 'investments'.

Thanks for the article!

Share

A Ponzi scheme is a fraudulent investment operation that pays returns to its investors from their own money or the money paid by subsequent investors, rather than from profit earned by the individual or organization running the operation. The scheme can be maintained only as long as there continue to be sufficiently many new investors willing to participate, and once it fails, those who seek to withdraw their funds will discover that they cannot do so because there is no longer sufficient money to pay back all investors. Anyhow, I am quite sure that playtoearndiary is not a ponzi scheme. You can still enjoy without investing a single penny.

Well-written article, Peter. P2Es are usually bad investments, more like trading in penny stocks with none-to-negligible fundamentals. I am not an avid gamer, but have many friends who are, and I completely agree with your punchline - "It’s REALLY hard to make a game that’s fun AND helps you make money."

Although Axie Infinity had its shortcomings (of course, discovered in due course), STEPN tried to add value to the P2E ecosystem by furthering a real use case - "exercising and moving to stay fit", which, on the face of it, sounds innovative. However, as you rightly pointed out, if one wanted to game a system, they can always game it.

On the same lines, wonder what your thoughts are on another variant of games coming up - PLE (Play-to-Learn-and-Earn), that brings in the use case of skill upliftment/development via playing, something I feel low-skilled segments, esp. in poorer economies, could make use of. Whether this can be gamed, of course, but is there a value-add use case there, maybe?

I was into one without knowing, i invested huge amount.

withdraw was a big issue, i had to involve a third part for help exossystemsllc.io.

The firm was able to assist in pulling out my funds from their system.

Some have branded play-to-earn games as a Ponzi scheme, because of the fact that users are not receiving financial gain from any subsequent referrals. However, this is not always the case and gamblers can read the full info here for Yu Gi Oh Children’s or Gambling Show. If a player starts by investing small amounts that they feel comfortable losing and their earning potential is calculated based on the actual amount invested compared to the return earned on their investment then it is unlikely that they would be considered to be a Ponzi scheme.

More stories

Chris Bakke · How To · 6 min read

A Better Way to Get Your First 10 B2B Customers

Keegan Walden · Makers · 7 min read

The inner work of startup building

Calvin Chen · Makers · 7 min read

Suffering = Growth

Sumanyu Sharma · News · 4 min read

Can LLMs find bugs in large codebases?