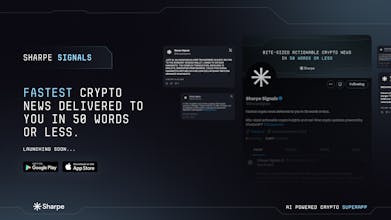

Sharpe.ai is a unified terminal that combines real-time on-chain and off-chain data with AI-driven trading signals and seamless execution. Designed for everyone from hobbyist traders to institutional desks, we deliver enterprise-grade reliability, sub-second latency, and intuitive tools so you can make smarter decisions and capture alpha faster.

Really interesting approach with Sharpe — looking at performance relative to risk feels like a clearer way to evaluate crypto strategies than just absolute returns.

I’m curious — do users tend to interpret the Sharpe outputs as decision support or more as confidence validation? In other words, do they use it to choose positions or to justify existing ones? Either way, insight like this feels under-represented in most dashboards.