Launching today

Vistaley

The two-sided VC platform for simple fund management

4 followers

The two-sided VC platform for simple fund management

4 followers

Most VC fund management tools only serve one side. GPs use expensive platforms like Carta or Visible.vc to track portfolios — but the data is stale because it depends on founders manually filling out reports they hate. Meanwhile, founders are cobbling together spreadsheets for FP&A because proper tools cost $50K+/year. Both sides lose.

Vistaley connects both sides of the investment process through two purpose-built products:

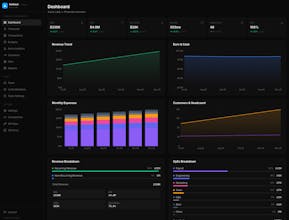

🔭 VentureLens — Full fund management for GPs: deal pipeline, portfolio tracking, fund accounting across 12 jurisdictions, LP reporting, multi-currency support (60+ currencies), and real-time portfolio analytics. Built for emerging market funds managing $5M-$500M.

⚓ Harbour — Free FP&A tools for portfolio companies: financial snapshots, MRR/ARR/burn rate dashboards, KPI tracking, and transaction management. When a portfolio company uses Harbour, their data flows automatically to their GP's VentureLens dashboard — creating a real-time data pipeline that eliminates quarterly reporting theatre.

The magic is the data flywheel: GPs get live portfolio insights without chasing founders. Founders get genuinely useful FP&A tools at no cost. The more portfolio companies that use Harbour, the richer the GP's analytics become. It's the first time both sides of the VC relationship benefit from the same platform.

We built Vistaley for emerging market VCs — the funds investing in Kazakhstan, Pakistan, Bangladesh, and other high-growth regions that global platforms ignore. That means real multi-currency support (not just USD), jurisdiction-aware accounting standards, and pricing that makes sense: Free tier → $49/mo → $149/mo → $399/mo — roughly 95% less than enterprise incumbents.