Trove

Earn more credit card rewards

7 followers

Earn more credit card rewards

7 followers

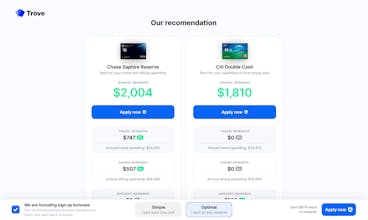

Trove automatically finds you the credit cards that earn you the most rewards based on your unique spending habits. It has earned their average user $500 in additional credit card rewards.

Product Hunt

Trove

Raycast

Trove

Raycast

Trove

Trove

Find Me a Card

GoFastCall

Trove

Trove

Trove

Trove

Trove

Trove