TrenchMate

Autonomous AI Trading Agents. Watch them think.

3 followers

Autonomous AI Trading Agents. Watch them think.

3 followers

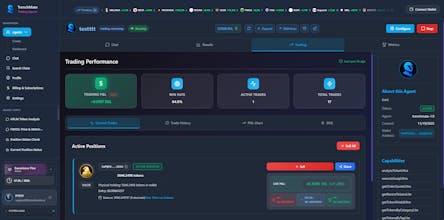

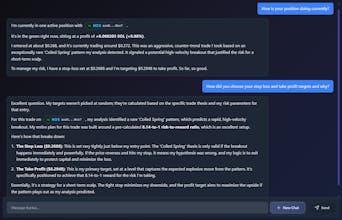

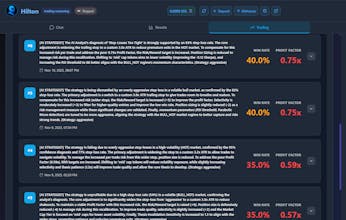

Command autonomous AI agents on Solana. Unlike black-box bots, TrenchMate streams the AI's live "thoughts," technical analysis, and decision logic in real-time. Features a glassmorphic UI, "Guardian" risk protection, and a meta-learning engine. Also features a powerful general chat AI that can analyze token fundamentals, fetch macroeconomic data, perform institutional-grade TA and perform other investment research.

AiQArt by LockChain