Launching today

StockAInsights

AI-powered stock data that rivals $20K terminals

1 follower

AI-powered stock data that rivals $20K terminals

1 follower

Tired of financial APIs with missing quarters and wrong data? StockAInsights uses AI to extract institutional-grade data directly from SEC filings—400+ metrics across 12+ years with ZERO missing quarters. → AI-Generated Investment Stories that surface risks, margin pressures and red flags in plain English → Full API Access for your models → DCF tools, Stock Alerts, Smart Money tracking, 170+ Academy guides and many more The accuracy serious modeling demands. Free tier available.

Hey Product Hunt! 👋

I'm excited to share StockAInsights after almost a year of obsessive building.

The backstory: I'm a long-time investor who got burned by one of those popular (expensive!) financial data APIs. Missing quarters everywhere, wrong calculations, constant bugs. I was sending bug reports weekly. Eventually gave up.

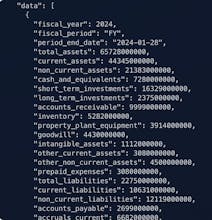

So I decided to fix it myself. Started with the "proper" approach—XBRL extraction using tools like Arelle. Quickly learned why most APIs are broken: it's nearly impossible without tons of manual work. SEC has classification errors, companies use custom fields, there's incorporation by reference, mergers, CIK successions... it's a nightmare.

The breakthrough: I spent the last year building a multi-strategy AI system that extracts data directly from SEC filings. The results honestly shocked me.

What I've got:

- 550+ companies (S&P 500 + notable names like Alibaba, TSM, NIO and many more)

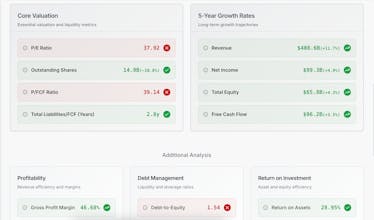

- 400+ normalized fields across all three financial statements

- Virtually Zero missing quarters (12+ years historically or since IPO date)

- Industry-specific templates—banks, insurance, REITs, energy, utilities

- Smart AI Insights - Free-form chatbot where you ask any question about stocks, compare companies across industries, get instant answers based on complete financial data

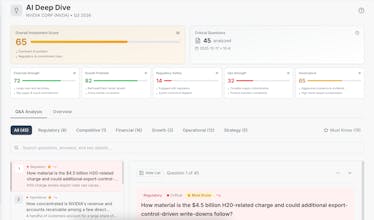

- AI Deep Dive - Automated analyst that scrutinizes every SEC filing and asks critical questions investors miss.

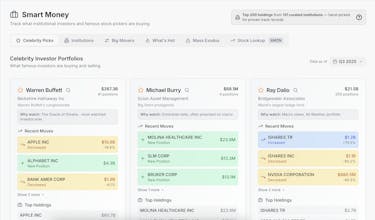

- DCF valuation tools, 175-pages Investors Academy, full API access, institutional and insider trading, mergers/acquisitions/key events and many more. There are a ton of features already.

- The AI also reads the full 10-Ks and pulls out the stuff that actually matters - risks, red flags, margin pressures, all summarized so you don't have to read 200 pages yourself.

And yes - full API access is included. Same data, ready for your own models, spreadsheets, whatever you're building. That was a big priority for me because I wanted this data for my own stuff too and I know how valuable it is.

The data density is wild. While other APIs return 2 fields for some quarters, ours consistently delivers complete data for every period.

What's next: More companies (targeting 6,000+), international markets, extensive 8-K processing.

Free tier available so you can test the quality yourself. Would love to hear what you think!