Do you use Shake pay?

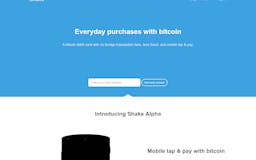

What is Shake pay?

The easiest way for Canadians to buy and earn bitcoin

Recent launches

Shakepay Change

Canadians buy bitcoin automatically by rounding up their everyday purchases and turn spare change into bitcoin

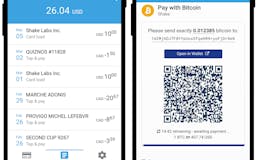

Shakepay

Shakepay is the easiest way for 🇨🇦Canadians🇨🇦 to buy & sell bitcoin. It's super easy, you sign up, tell us who you are, send us an Interac e-Transfer, and bam! you’re owning crypto.