Nivesh Multiplier

Data-backed AI for Indian mutual fund portfolios & research

4 followers

Data-backed AI for Indian mutual fund portfolios & research

4 followers

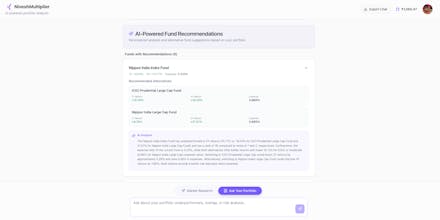

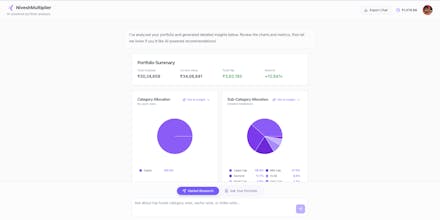

NiveshMultiplier (Nivesh Multiplier) is your intelligent money partner. Analyze your portfolio, detect underperforming funds, and get AI-backed rebalancing recommendations. Optimize your wealth today.

Free

Launch Team

Unblocked AI Code Review — High-signal comments based on your team's context

High-signal comments based on your team's context

Promoted

Maker

📌Report