Do you use Joy?

What is Joy?

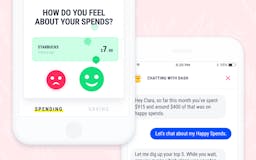

Joy is the brand new money app that will change the way you spend and save money to help you find more happiness in your life.

Recent launches

Joy

Joy is the brand new money app that will change the way you spend and save money to help you find more happiness in your life.