Sail

A business toolkit built for freelancers.

5 followers

A business toolkit built for freelancers.

5 followers

Sail is now CalendarPay. CalendarPay helps business owners receive credit card and bank (ACH) payments while saving money and avoiding hassle with our secure payments scheduler.

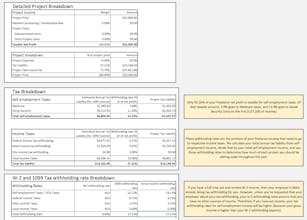

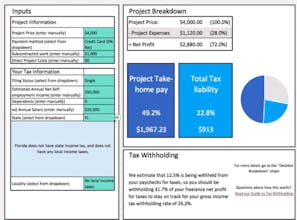

Obviously, anything made in spreadsheets has a lot of room for UI improvement, but those struggles are all meaningless when you recognize the value of this calculator. As a freelancer, it's always unclear how much money you're actually taking home from a project and making sure you're not underpricing yourself. This is something that gets better over time as a freelancer, but in the mean time he/she is leaving money on the table, underpricing themselves, or, worst case scenario, losing money on projects. I'm super impressed by the ease of use and value of information.

Pros:Super easy to use

Cons:The UI has room for improvement

Oversubscribed

HelpDocs

Oversubscribed

Oversubscribed

Arrows

Oversubscribed

The folks at Sail are doing great things for freelancers - pay attention to them!

Pros:This is a huge value to freelancers, helping with a very stressful problem in a time saving way

Cons:It's a google sheet - obviously it's not perfect and doesn't have beautiful UI, but it does its job and does it well

Oversubscribed

Strikingly