EconPulse

Turn global economic noise into personalized trading signals

1 follower

Turn global economic noise into personalized trading signals

1 follower

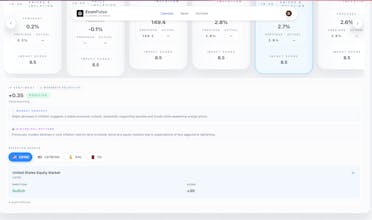

Don't watch the whole world. Watch your world. Get personalized briefings and stop guessing how the Fed or NFP affects your assets. Most economic calendars are static lists of data. EconPulse is the first platform to bridge the gap between macro events and your portfolio. Powered by AI v2.4, we contextualize every release. We analyze news sentiment in real time, predict volatility with quantitative impact scores, and map specific risks directly to your tickers like NVDA or AAPL.

Free Options

Launch Team

Flowstep — Generate real UI in seconds

Generate real UI in seconds

Promoted

Maker

📌Report