DeFi Saver

One-stop management app for decentralized finance

6 followers

One-stop management app for decentralized finance

6 followers

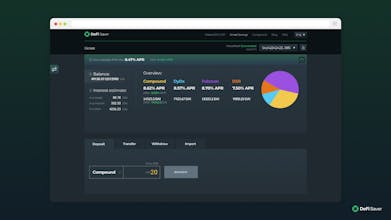

DeFi Saver is a management application for decentralized finance protocols on Ethereum that includes: ✅MakerDAO CDPs management with automatic liquidation protection ✅Smart Savings lending with Compound, dYdX and Fulcrum support ✅Compound positions management