Blair

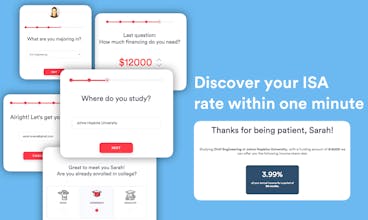

Better Student Financing through Income Share Agreements

7 followers

Better Student Financing through Income Share Agreements

7 followers

We finance your tuition or costs of living. After you graduate, you pay back a percentage of your income for a fixed period of time.

Fastgen

Clubhouse

Fastgen

Comradery

Fastgen