AI Family Budget Tracker

Family budgeting that doesn't feel like homework

6 followers

Family budgeting that doesn't feel like homework

6 followers

Most budget apps make you manually enter every transaction or rely on broken bank connections. We took a different approach: just upload your bank statement (PDF or image), and our AI extracts everything automatically. Set budget limits per category, create savings goals with visual progress tracking, and see where your family's money actually goes. No spreadsheets, no data entry fatigue. Built for families who want to save more without the admin work.

Hi Product Hunt,

I'm a Software Developer. I built this because my wife and I were tired of fighting with spreadsheets and bank apps that constantly broke.

The problem: every budget app either wanted read-only access to our bank accounts (which breaks every few months) or made us manually type in every coffee purchase. Both options felt exhausting.

So I built something different. You just upload your bank statement as a PDF or screenshot. The AI reads it like a human would and extracts all your transactions automatically.

But the real magic is what happens next:

Budget Limits: Set spending caps per category. Get warnings before you overspend, not after.

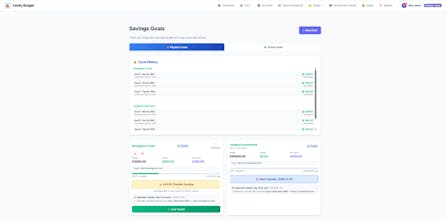

Visual Goals: Saving for a holiday or a new car? Create a goal, track progress with a visual bar, and actually see yourself getting closer.

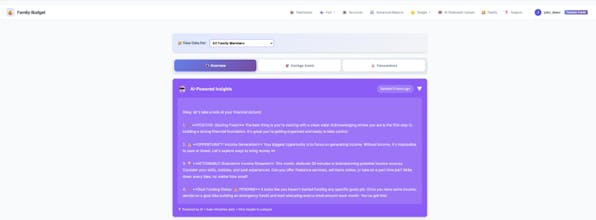

Family View: See individual spending and household totals in one place. No more "wait, did you already pay for that?"

I've been using this with my family for months now. It's honestly changed how we think about money. We're not perfect, but we're way more intentional.

Would love to know if this resonates with you. What's the biggest pain point in your current budgeting setup?

Watch it in action:

Getting Started: https://youtu.be/6A-a05-7EyY

AI Magic: https://youtu.be/HDBsRohr4MY

Daily Management: https://youtu.be/dp7UjwSKKNI

Family & Goals: https://youtu.be/cNX4KMHSyl8

Security & Privacy:

I know trusting a budget app with your financial data is a big deal. Here's exactly how we handle your information:

What We DON'T Do:

❌ Sell your data to third parties

❌ Require bank login credentials

❌ Use your data to train public AI models

❌ Share transaction details with advertisers

❌ Store unencrypted sensitive information

What We DO:

✅ Encrypt all data (AES-256 at rest, TLS in transit)

✅ Let you export or delete ALL your data anytime

✅ Use AI locally for categorisation (your data stays in our secure database)

✅ Follow GDPR principles (even if you're not in EU)

✅ Offer manual statement upload (no risky bank API connections)

You're in Control:

- Want to delete everything? One click in settings.

- Want to export your data? CSV download available.

- Want to see what we store? Transparent data access.

Why Manual Upload?

Many apps use Plaid/TrueLayer to connect to your bank. Those connections break constantly and require ongoing access. We chose manual upload because:

1. You control what we see

2. No recurring bank permissions

3. More secure (no API vulnerabilities)

4. Works with ANY bank worldwide

Questions? I'm here all day. Transparency matters.

RAW

New Feature: Magic Drop (Automated Budgeting without Plaid)

We just launched a major update to Family Budget Tracker: The Magic Drop.

You can now automate your budget without ever sharing your bank credentials. Our Secured Service Bot now uses AI to parse statements directly inside your Google Drive.

To celebrate the feature launch, I'm opening 5 Free Lifetime spots for the PH community and 20 spots at 50% off.

To participate:

Sign up at https://family-budget.getdigraw.com/

Try the statement upload.

Email support@getdigraw.com with the subject "PH Beta" and your feedback.

I'll be upgrading accounts manually all afternoon!