Launching today

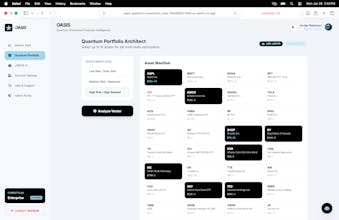

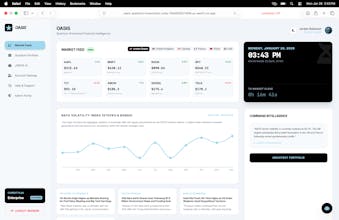

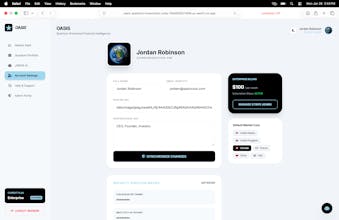

OASIS: Quantum-Classical Finance Hybrid

20 years of market data analyzed in 20 mins on a laptop

1 follower

20 years of market data analyzed in 20 mins on a laptop

1 follower

We were told the Quantum Advantage in finance was 10 years away. We didn't want to wait. OASIS uses Q# (Grover’s Algorithm) and a proprietary LLM to bypass classical compute bottlenecks. While hedge funds spend millions on server time, OASIS lets retail investors run simulations on 50 stocks across 6 global markets in under 20 minutes, and analyze 20+ years of market data—locally. No black boxes. No 'AI magic.' Just raw, quantum-accelerated optimization for the rest of us

Payment Required

Launch Team

AssemblyAI — Build voice AI apps with a single API

Build voice AI apps with a single API

Promoted

Maker

📌Report