Launching today

WAIT

AI-Driven Trading Intelligence and Risk Insights

1 follower

AI-Driven Trading Intelligence and Risk Insights

1 follower

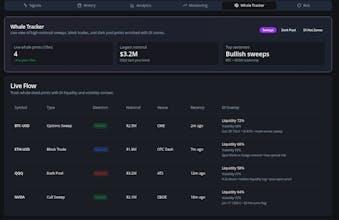

WAIT Inc. is an AI-driven trading intelligence platform built for serious traders, prop-firm candidates, and performance-focused institutions. We do not operate as a broker or advisor. We provide technology: real-time market signals, regime detection, and automated risk enforcement that helps users trade with discipline and consistency.

Free Options

Launch Team

AssemblyAI — Build voice AI apps with a single API

Build voice AI apps with a single API

Promoted

Maker

📌Report