Launched this week

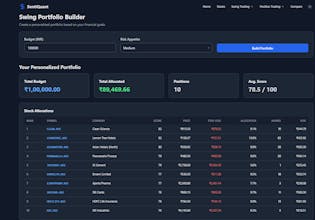

SentiQuant

Smarter trading decisions, built on risk.

4 followers

Smarter trading decisions, built on risk.

4 followers

Sentiquant is an AI-powered trading analysis platform built for Indian stock markets, focused on risk over prediction. Instead of telling users what to buy or sell, Sentiquant combines news sentiment, price action, and technical risk metrics to help answer one question: Is this trade worth the risk right now? We built Sentiquant after learning firsthand that being “right” about the market isn’t enough drawdown control and discipline matter more than forecasts.

Free

Launch Team / Built With

AppSignal — Get the APM insights you need without enterprise price tags.

Get the APM insights you need without enterprise price tags.

Promoted

Maker

📌Report