Q&A: Own Nothing, Carl Pei’s new consumer tech venture

By now, you've likely heard of former OnePlus Co-founder Carl Pei’s new tech venture called Nothing, but if not here is the latest update, alongside some exciting news for Product Hunt readers.

We caught up with Carl to discuss his vision behind Nothing and how the company is inviting its community to get involved from the ground up.

Tell us about Nothing and what we can expect to see from you this year?

Our mission at Nothing is to remove barriers between people and technology to create a seamless digital future. We believe that the best technology is beautiful, yet natural and intuitive to use. When sufficiently advanced, it should fade into the background and feel like nothing. Our long-term plan is to build an ecosystem of consumer tech products with this vision in mind, starting with our first product launches later this year, which will include true wireless earbuds

You recently announced a community funding round, can you tell us more about that?

We are grateful to have secured $22 million in funding so far, including seed financing from inspiring tech leaders such as Josh Buckley, CEO of Product Hunt and Steve Huffman, Co-founder and CEO of Reddit. It’s important to me that our community is involved in this journey as well so we are inviting them to invest a total of $1.5 million in Nothing at the same valuation as our Series A funding with GV (formerly Google Ventures).

How can the Product Hunt community get involved?

Firstly, everyone must pre-register their interest in investing in the company on nothing.tech. The shares will be available on Crowdcube on a first-come, first-served basis to everyone who pre-registered starting on the morning of 2nd March 2021 (European time).

So far we have received over $27M of registered interest from over 20,000 people. Once you receive the private link from Nothing via email, you’ll have to be really fast to pledge your investment!

Here's how it works:

1. Submit your email for early access to our investment opportunity. *If you live in the United States, Canada, Japan or any country where you think crowdfund based equity might be restricted: please read the FAQ and do your research before registering as you might not be able to invest.

2. Make sure you select Product Hunt on the drop-down list for where you heard about this

3. Go to Crowdcube and create an account. This is where the investing will take place once we go live.

4. Have a credit or debit card ready, sit tight and wait for the email from Nothing. We’ll send you a notification a few minutes before go time, be sure not to miss it!

Why is community so important to you? How else are you getting users involved in these early days?

Most people would have to wait for an IPO to invest in a company, but by that time, the valuation may already be high. We want to make it possible for our early supporters and future users to be front and center from the very beginning, not just cheering from the sidelines. From here, investors will also have access to a private Nothing forum and some exclusive benefits. As part of this process, we’ll be electing a community member to our board of directors, so that we’re always kept in check, and reminded of what users want. Having our community involved in every step of our evolution will be integral to our chance at success and I cannot wait to talk more with them, listen to their ideas and feedback and make Nothing the best that we can be.

Having said that, I also want to take the chance of reminding everyone of the risks involved. While the team and I will be doing our best, statistically speaking most startups fail. So please only invest money that you can afford to lose.

To find out more about Nothing, visit nothing.tech and @nothing.

Disclaimer: It’s important you know that investing in start-ups and early-stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio.

We caught up with Carl to discuss his vision behind Nothing and how the company is inviting its community to get involved from the ground up.

Tell us about Nothing and what we can expect to see from you this year?

Our mission at Nothing is to remove barriers between people and technology to create a seamless digital future. We believe that the best technology is beautiful, yet natural and intuitive to use. When sufficiently advanced, it should fade into the background and feel like nothing. Our long-term plan is to build an ecosystem of consumer tech products with this vision in mind, starting with our first product launches later this year, which will include true wireless earbuds

You recently announced a community funding round, can you tell us more about that?

We are grateful to have secured $22 million in funding so far, including seed financing from inspiring tech leaders such as Josh Buckley, CEO of Product Hunt and Steve Huffman, Co-founder and CEO of Reddit. It’s important to me that our community is involved in this journey as well so we are inviting them to invest a total of $1.5 million in Nothing at the same valuation as our Series A funding with GV (formerly Google Ventures).

How can the Product Hunt community get involved?

Firstly, everyone must pre-register their interest in investing in the company on nothing.tech. The shares will be available on Crowdcube on a first-come, first-served basis to everyone who pre-registered starting on the morning of 2nd March 2021 (European time).

So far we have received over $27M of registered interest from over 20,000 people. Once you receive the private link from Nothing via email, you’ll have to be really fast to pledge your investment!

Here's how it works:

1. Submit your email for early access to our investment opportunity. *If you live in the United States, Canada, Japan or any country where you think crowdfund based equity might be restricted: please read the FAQ and do your research before registering as you might not be able to invest.

2. Make sure you select Product Hunt on the drop-down list for where you heard about this

3. Go to Crowdcube and create an account. This is where the investing will take place once we go live.

4. Have a credit or debit card ready, sit tight and wait for the email from Nothing. We’ll send you a notification a few minutes before go time, be sure not to miss it!

Why is community so important to you? How else are you getting users involved in these early days?

Most people would have to wait for an IPO to invest in a company, but by that time, the valuation may already be high. We want to make it possible for our early supporters and future users to be front and center from the very beginning, not just cheering from the sidelines. From here, investors will also have access to a private Nothing forum and some exclusive benefits. As part of this process, we’ll be electing a community member to our board of directors, so that we’re always kept in check, and reminded of what users want. Having our community involved in every step of our evolution will be integral to our chance at success and I cannot wait to talk more with them, listen to their ideas and feedback and make Nothing the best that we can be.

Having said that, I also want to take the chance of reminding everyone of the risks involved. While the team and I will be doing our best, statistically speaking most startups fail. So please only invest money that you can afford to lose.

To find out more about Nothing, visit nothing.tech and @nothing.

Disclaimer: It’s important you know that investing in start-ups and early-stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio.

Comments (1)

Henry Fieldse

More stories

Aaron O'Leary · Announcements · 2 min read

Introducing Shoutouts

Finn Lobsien · Opinions · 5 min read

Can Devin AI Replace Product Managers?

Aaron O'Leary · News · 2 min read

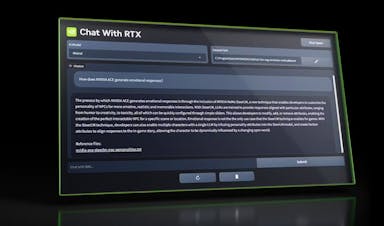

Meet Nvidia's new localized AI chatbot

Sarah Wright · News · 2 min read

The top 15 AI products from 2023