NFT economics

Why the art market gives us one of the best models for digital economics

David Phelps is a 2x founder, a cocreator of ecodao and jokedao, and an investor in web3 projects through the angels collective he started, cowfund. Find him on Twitter at @divine_economy.

Why is information being priced as art?

While the question might not seem strange to artists who have made information their primary medium for over 50 years, it appears to challenge 25 years of orthodoxy for digital vendors suddenly able to sell links to jpegs for millions of dollars as NFTs. “Commentators marvel at the amount of free information on the Internet, but it’s not so surprising to an economist,” wrote Carl Shapiro and future-Google-Chief-Economist Hal Varian in 1998’s Information Rules. “The generic information on the Net are simply selling at marginal cost: zero.” Those zero marginal costs, allowing digital information and goods to reproduce freely across the internet, seem to stand in full opposition to art economics, which incur incredible costs to produce a single painting or sculpture, ship it to art fairs, and publicize it in press releases without any real hope for replication.

So in some ways, the most startling thing about NFTs is that they show us that the economics of the art world, comprised to a great degree of individual works of inconvenient physical proportions, are not only able but appropriate to apply to a digital market of infinitely reproducible Fortnite skins. After all, a good part of what has driven the massive success of SaaS over the past decade has been the ability of software to scale with minimal marginal cost, effectively dropping the supply curve from the supply-demand graph and finding new ways to tap into the consumer surplus of the demand curve with different tiers of service.

What NFTs reveal, first and foremost, is that this is actually a terrible economic proposition for most creators. Creators don’t need massive scale, necessarily; even the most successful creator will interest a small percentage of the population. They do, however, need to find ways to effectively monetize the subcultures invested in their work. In other words, what NFTs show us is that it’s better for creators to artificially limit their supply of content in order to get a few people to pay a great amount of money.

And it’s here that we get our answer not only for why information is being priced as art—but why, despite all appearances, the art market offers one of the best models for digital marketplaces. Shapiro and Varian identify it themselves: “To an executive rolling out a new software product or introducing the on-line version of a magazine, supply and demand curves just don’t help much.” The premise of the art market, that the supply-and-demand curve cannot hold, turns out to be the premise of the digital market as well. In both, the supply curve falls out entirely, leaving only a demand curve in its place that becomes increasingly inelastic with limited items.

Or to put that another way, in both the art and digital market, value is so totally untethered from the conditions of production as to seem utterly made-up. Indeed, by commanding high prices for links to jpegs, NFTs winkingly presume the scarcity of a non-existent item that’s as much a mutually-agreed-upon fiction as money itself. That’s one way that NFTs offer us a lesson in how the art world’s post-supply-demand economics make perfect sense for digital economies, but there’s another too.

Most significantly, perhaps, NFTs point towards a world in which value, like content, will increasingly be personalized to the user. This too was an insight of Shapiro and Varian, who wrote that online “you can sometimes arrange for multiple, and even personalized, prices.” The art world had already been arranging it for years. NFTs, however, offer the first opportunity for creators to take advantage of it online.

We can see how this works by dismantling both the demand and supply curves for art and virtual marketplaces.

***

Demand Lines and Curves

Let’s start with the demand curve.

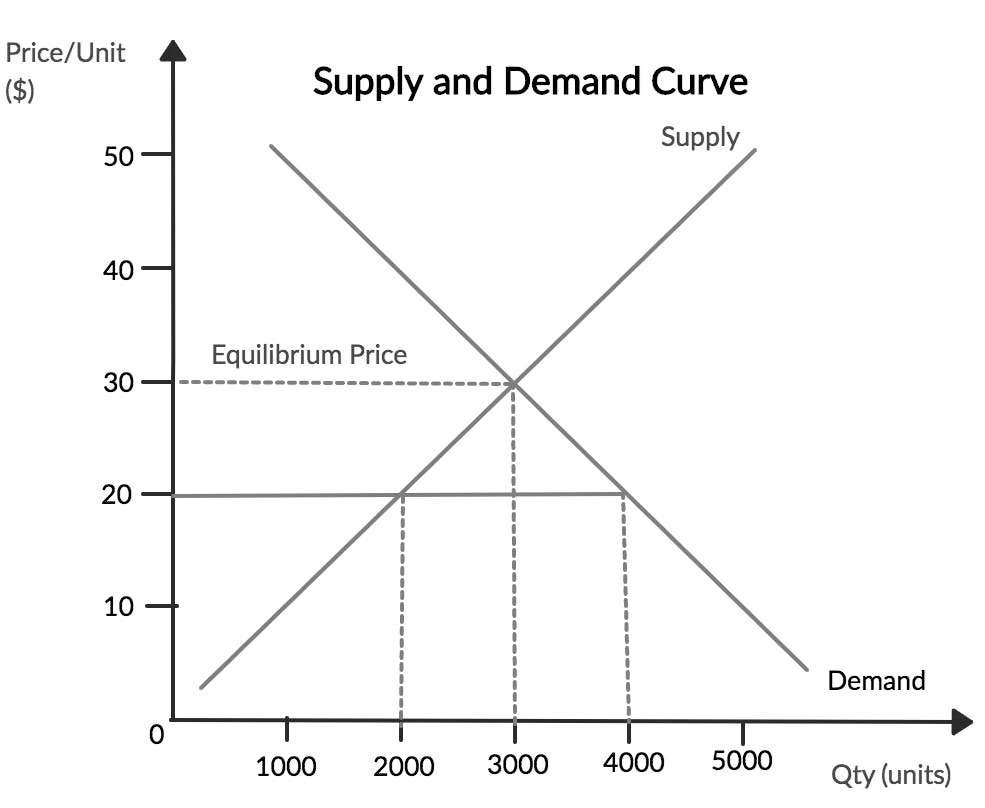

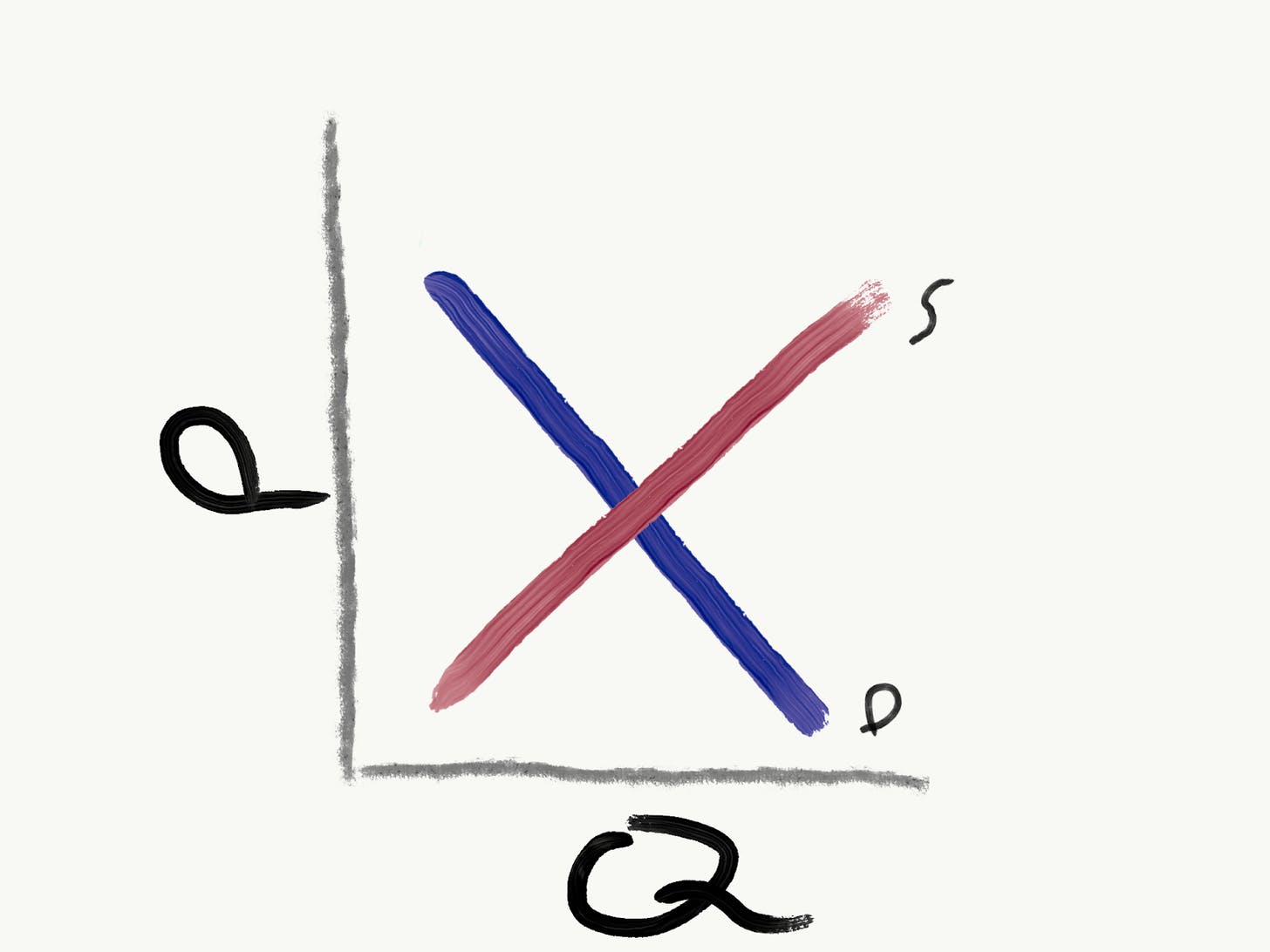

The demand curve of a traditional supply-demand chart like the one above is, of course, not a curve at all. Instead, it’s drawn as a straight line showing how firms can make more money the less they charge, at least up to a point.

This is the classic formulation: as a price goes down y dollars, x more people will want to pay for it. Even if the supply curve didn’t exist, there would still be an ideal price to charge. We can determine that point of revenue-optimization quite simply by drawing a square under the graph, making sure the top right corner intersects the demand line. If the company keeps lowering prices past that point, it will draw more consumers, but it will start losing revenue since all of its previous consumers will be paying a lower price as well. So, using the textbook chart above, if you want to charge an expensive $50 for a meal, there would in theory be 1,000 people willing to pay for it (total revenue of $50,000), assuming there were no competitor offering a similar option for cheaper. However, if you charge a moderate $30, there would be 3000 potential consumers (total revenue of $90,000)—and if you charge a paltry $10, there would 5000 prospective eaters ($50,000 total revenue). We arrive at a kind of Goldilocks theorem: try not to charge too much or too little, but charge what is just right.

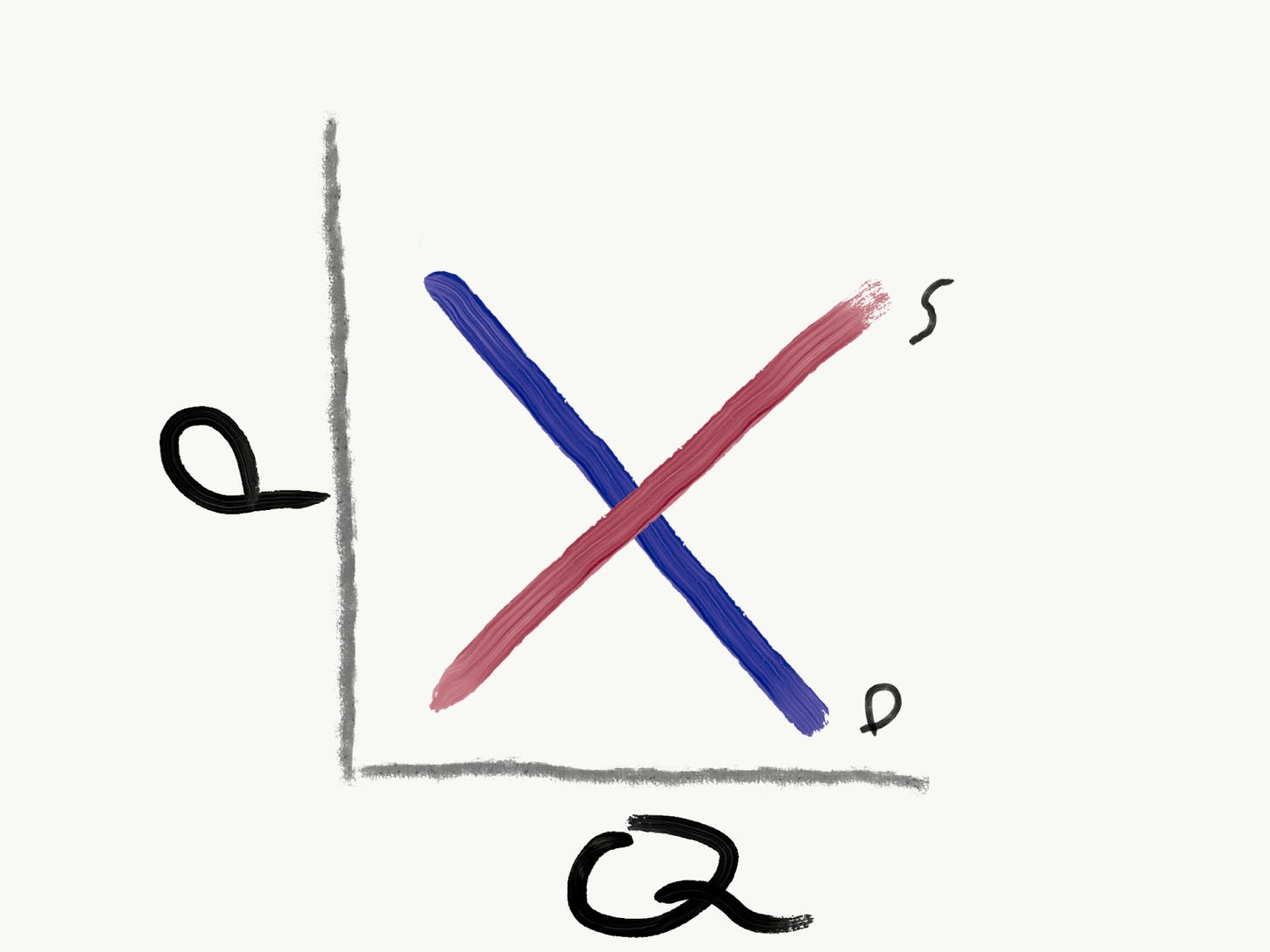

But what if you’re in a market of just a few buyers and sellers rather than thousands? Instead of a traditional demand graph like this…

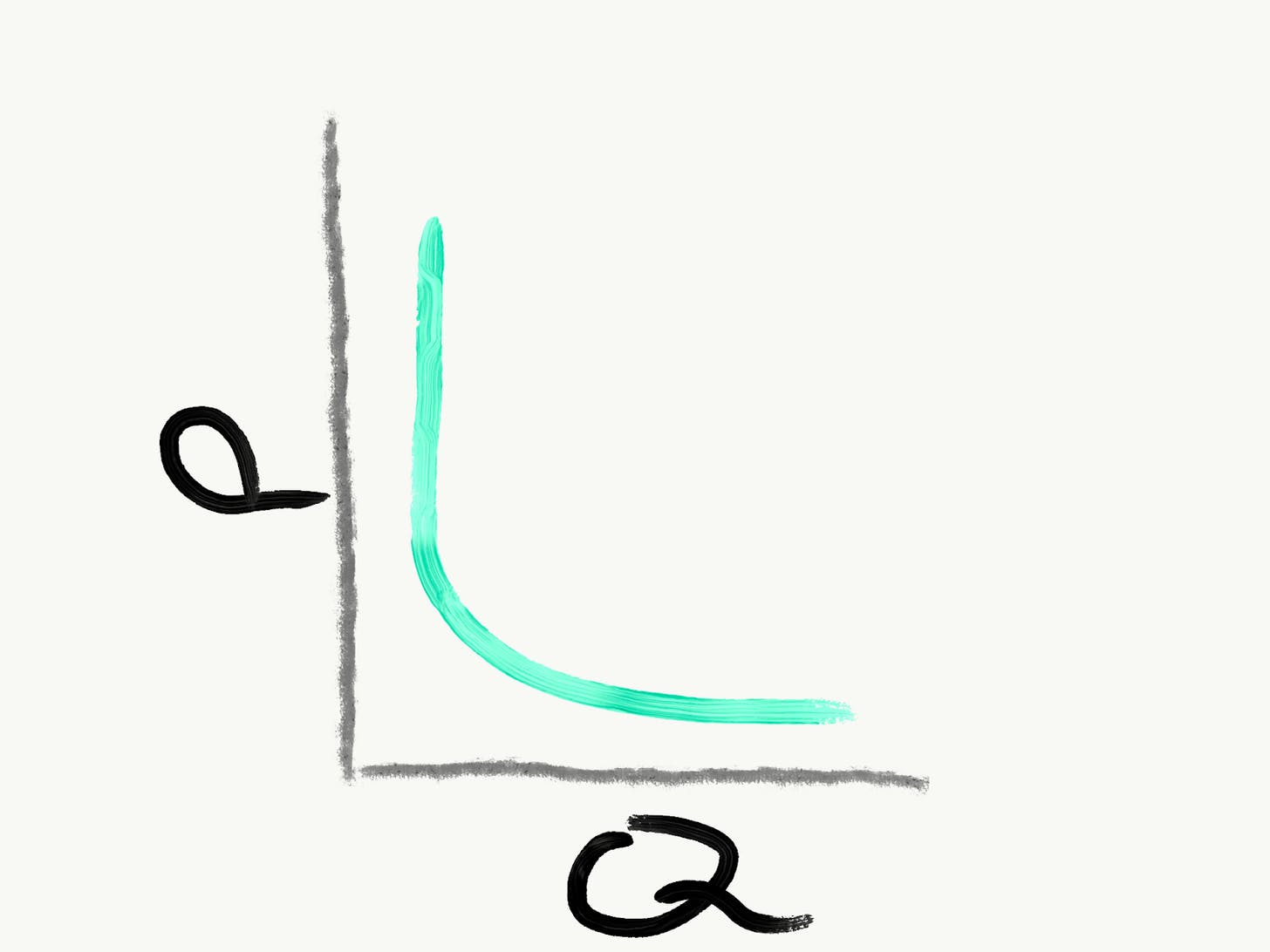

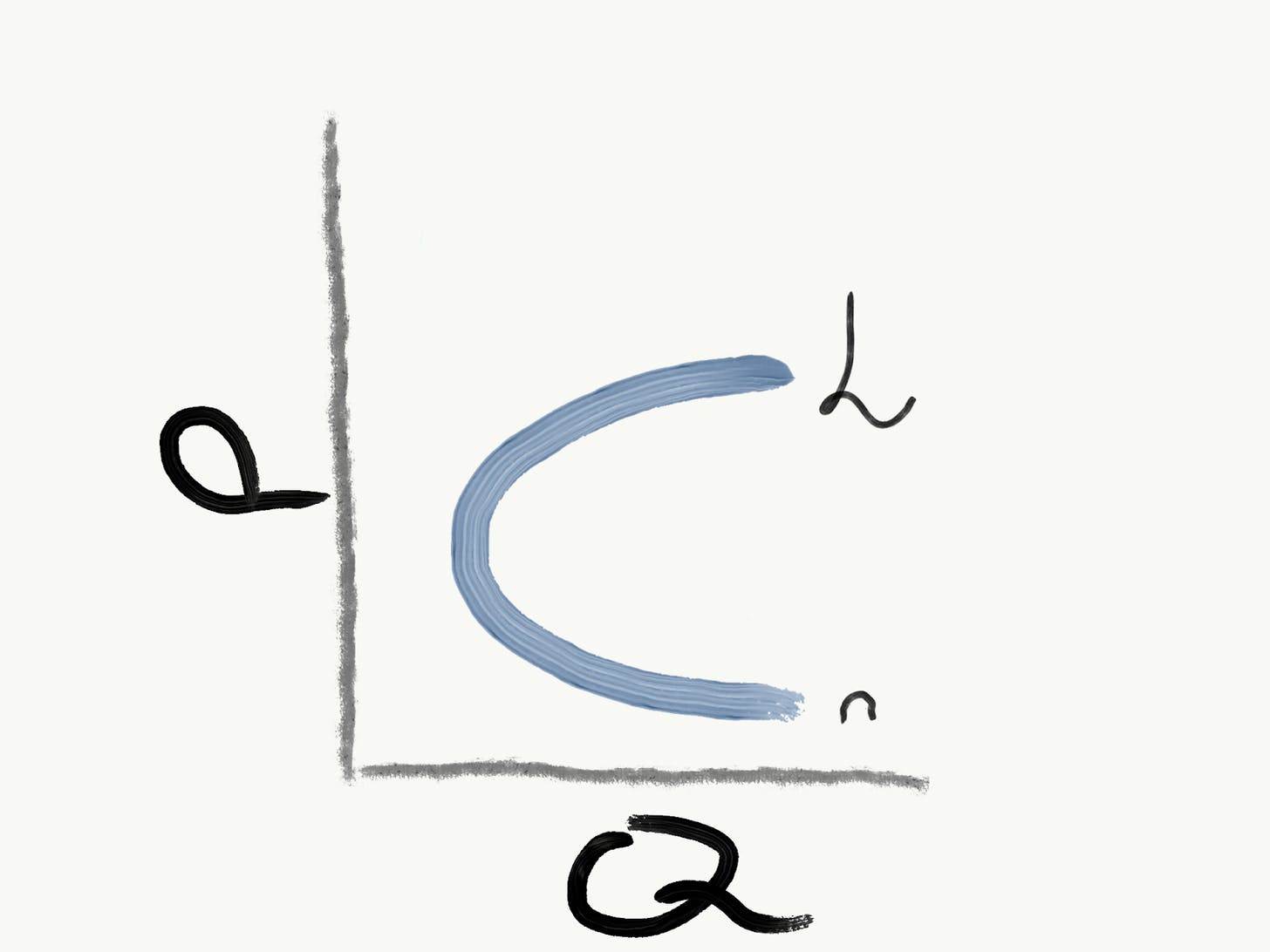

...we can imagine an actual parabolic demand curve like this:

The graph becomes increasingly inelastic as we move to the left: we can charge huge sums for a product or a service if we only want a couple potential buyers. Art auctions will often result in these kinds of graphs, as two eager buyers push up the price of an artwork well beyond what a third might ever pay. As a result, it can become much more lucrative for an auction house to sell one item than it would to sell two since the auction house only needs two deranged buyers to push the price of a unique painting to infinity whereas it would need three deranged buyers to create a bidding war around two iterations of the same piece.

The demand curve, in other words, slopes down so suddenly that even by the second buyer, the auction house is past the point of profit-optimization. Of course, art is typically only available in one copy anyway, so this may seem like a moot point. It’s not. Photographs and prints offer the art world opportunities to experiment with supply and demand to create many iterations of the same work and find the equilibrium point that will maximize revenue. And part of what NFTs show us is that in high-end markets, the point of profit-optimization appears to land to the far left of the demand curve: when there is just one or a few iterations of an item that can be sold for a parabolically high price.

What do we make of this?

The obvious thing to say about NFTs is that they are designed to take advantage of the parabolic demand curve by selling reproducible digital goods in single copies and limited editions. If that sounds a bit like a scam—at a moment where NFT machinations can prize misogynist art in the tens of millions—then it reflects the “scam” of cryptocurrency as a whole, which releases often useless and easily reproducible digital currencies as “limited editions” of sorts with hard-capped supplies. And the scam of cryptocurrencies, in turn, reflects the “scam” of sovereign currencies that are artificially manufactured by states to generate value in an ecosystem. That is: if we want to be outraged about NFTs having no fundamental value, we might be outraged by money as a whole.

What’s more interesting is what NFTs’ parabolic demand curve says about the art world—and about digital goods. Any successful auction will result in two buyers jockeying for the highest possible price of a good, but why do art and NFTs go so high? Like just about any major work of art, NFTs are largely valuable both because of their artificially limited quantity and because of the context around the work (who made it, who owned it, how it’s been used publicly). Duchamp’s revolutionary view of a urinal as salon piece has become the standard model for late capitalist emperor-clothes valuation: conceptual art not only opens our eyes to see random, mass-manufactured banalities as artwork, but to see that they’re worth astronomical sums as artwork. But even that was hardly new in Duchamp’s time. We pay for context, including the context of what the market says we should pay. NFTs are reminders that a Serra or a Salle perched in the entryway just off the elevator is really just a certificate for the more valuable item you purchased, which is the ability to say that you own a Serra or a Salle.

When we understand that, we can understand that edition-of-one NFTs serve as luxury goods for the next generation of the haute bourgeoisie—influencers, cryptobros, and Twitch stars. Of course, many digital services need to be priced with more traditional demand curves. Dropbox or Netflix or Spotify all will maximize profit by lowering prices to reach more people. Digital products, however, are another story, not least because they’re almost certain to be luxury goods that have no significant use-value for the real world. CryptoPunks and Top Shot cards and Beeple art and Degen Waifus all serve similar functions for wealthy adolescents in the digital world as Judds and Kippenbergers do for wealthy art patrons in the real world: that is, as status symbols that we use talismanically both to broadcast our wealth to others and, just as importantly, our values to ourselves. They’re worth a lot because we use them to impress others by impressing ourselves, to reinforce the narratives we tell ourselves about ourselves.

All of this lands these items on the far left of the parabolic demand curve, where the curve turns inelastic. There might not be that many people who would value these items that much, but as long as there are more people than there are items, they can be valued infinitely high.

It only leaves off one other factor that feeds demand: scarcity, or rather, the perception of scarcity.

Supply Non-Lines and Non-Curves

The major challenge that the art and digital markets pose to a traditional supply and demand curve is much simpler than any of the above: there’s no supply curve at all. In the standard graph below, supply slopes upward because each successive unit costs more to make than the previous one, presumably because sourcing materials grows more and more expensive as companies have to reach beyond what’s readily available.

Nothing of the kind occurs in small businesses like pizza parlors and art galleries, where it’s usually cheaper to create and distribute items in bulk on a per-item basis, so each successive unit should cost less than the previous one; and nothing of the kind occurs in digital markets, where the marginal cost of producing goods is usually fairly negligible to begin with and gets cheaper as more goods are made. Indeed, one of the major advantages of SaaS in comparison to manufacturing firms is that marginal costs for virtual goods continue to decline, giving tech firms increasing returns to scale as they take over the market. In any case, as much as tiny art galleries and giant firms like Google may seem to be opposite businesses, we would do better to understand these markets by removing the supply curve entirely.

This is not to say that supply doesn’t play a role. But the role it plays is entirely in how it influences demand.

We can break that down by going back to our example of the auction house that would rather sell one item rather than two copies of the item because it only needs two deranged buyers rather than three to push the price. The logic here, which is based entirely on the demand curve, is admittedly a bit shaky. After all, Christie’s might sell a Picasso for $100 million as two potential buyers jostle the price higher and higher, but if there were even a third willing to approach that price, Christie’s might be able to sell two copies for, say, $80 million each. (Since we have three buyers, we would now have a bidding war for both of the copies, even if the third buyer is willing to pay less than the other two).

However, the reason this is unlikely to happen isn’t just because of demand—that each successive buyer is willing to pay less than the previous one—but because of supply, or rather, because of the perception of scarce supply. The fact that there is only one Picasso is part of what gives it its sky-high value to buyers, and none of the three would give a valuation remotely close to $100 million if they knew there was another copy.

In a way, what we’re talking about are Veblen goods, those goods that famously generate more demand the more expensive they are—goods like Lambos and Hermes handbags. But Veblen goods look like the opposite of the unique edition NFTs and Serras when we look at them as demand curves.

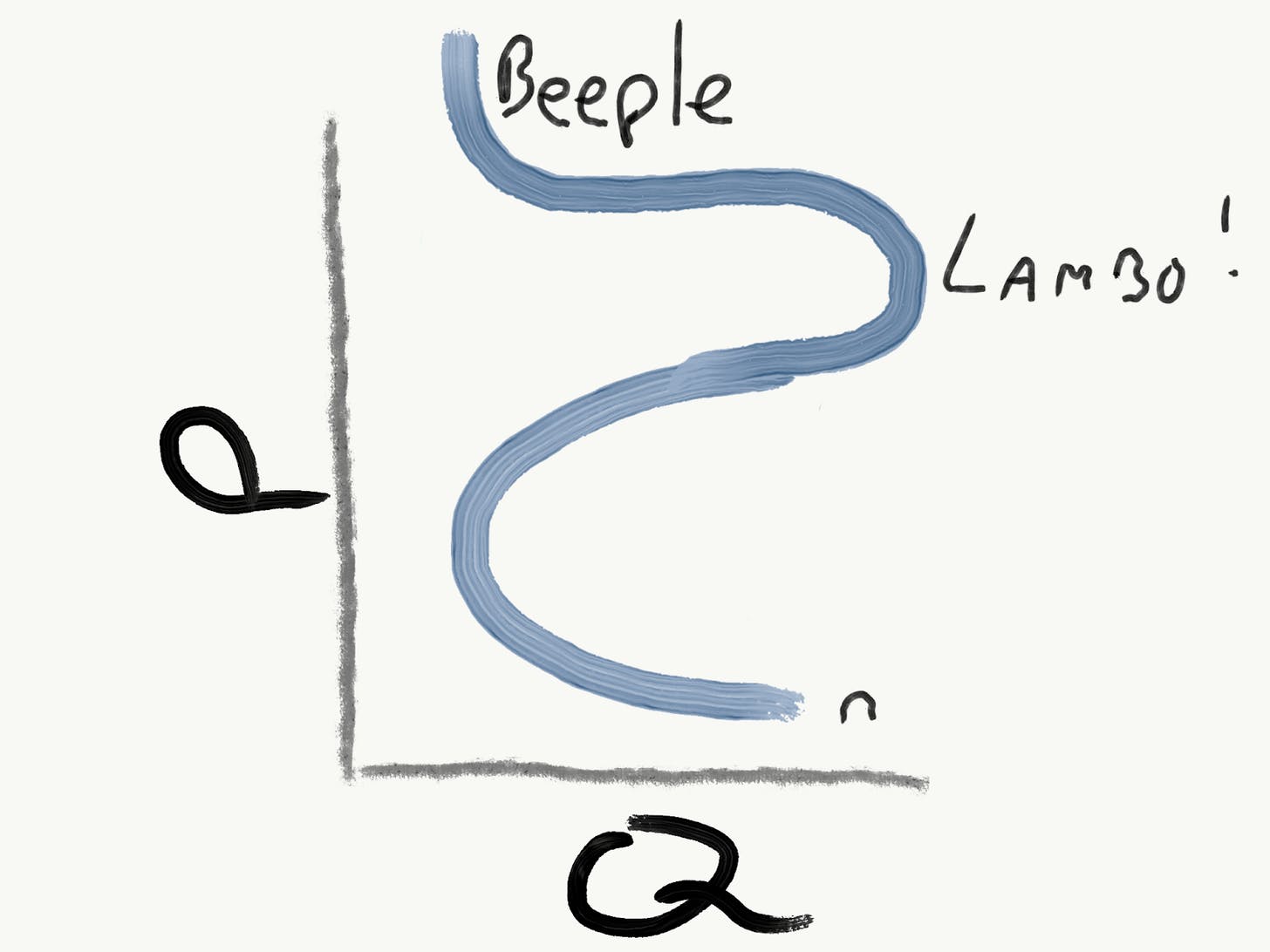

What the traditional Veblen demand curve shows above is two markets: a normal market (“n”), where more consumers are willing to pay for an item the lower its price, and a luxury market (fancy “L”), where more consumers are willing to pay for an item the higher its price. When we isolate the top half of the C, the luxury market, what we see is a curve sloping up logarithmically. But this seems like the opposite of what we described before for luxury goods, a demand curve sloping down parabolically.

In fact, we might reconcile these images by imagining a Veblen curve curving back up into a reverse C at the top.

Let’s just consider this reverse C at the top of the graph. When the price of an artwork is astronomically high or far too low, only one person will pay for it; when it’s fairly low or fairly high, some people will pay for it; and when it’s quite high (Lambo!), a number of people will pay for it. Lambos, similar to limited edition NFTs like NBA Top Shots, remain affordable to millions of wealthy people. They settle for being quite high to get a number of users; a Beeple or Picasso prefers to be astronomically high to get just one.

What is significant is that even though there is no supply curve here, both the Beeple/Picasso editions-of-one and the Lambo/Top Shot editions-of-a-hundred derive their value from a perception of scarcity. This scarcity appears to be entirely artificial. In the case of a Beeple, it would be easy to mass-manufacture NFTs for almost no marginal costs, but as we know from the parabolic demand curve, it wouldn’t necessarily be worth it when a single item can command so much more than all the items combined.

What about Lambos, which at some point will incur rising marginal costs? Here too, the scarcity is likely artificial. In other words, it’s possible that even if Lambos could manufacture many more cars at lowering marginal costs to a waitlist of buyers willing to pay their prices, they would be unlikely to do so. Why? Because once Lambo buyers knew that others could easily purchase one, the Lambo wouldn’t be worth as much psychologically.

In other words, scarcity drives up value in both normal and luxury markets, but for very different reasons. In a “normal” market of mass-manufactured digital goods, scarcity operates as a limiting factor derived from the intersection of the supply and demand curves—the point where increasing marginal costs outweigh the price a firm could get from a consumer. The more scarce an item, the higher its price. Luxury goods don’t actually counter this narrative. Yes, they tell us that the higher a price for a Lambo, the more people will buy it, at least until a point, but this greater demand of consumers still rests on the perceived scarcity of the item itself. People will pay more for the privilege of having something others can’t. Or in other words, people will pay more not only to acquire a good, but to prevent others from doing so too.

The high price itself, then, is a representation of scarcity, a signal to potential buyers that few others will be able to afford this item as well. In other words, luxury goods help us understand that scarcity operates as a psychological construct that influences demand itself. As Joel Spolsky wrote about digital demand curves in 2004: “Prices send signals.” In luxury markets, fewer items can lead to far high prices, not only because the market is limited to its highest buyers, but because the perception of scarcity itself drives prices higher.

And when we understand that—when we understand what it means to operate in a world without a supply graph or rising marginal costs or basic necessity, a world of pure status—we can understand the economics of digital marketplaces as well. Digital marketplaces are, as a whole, luxury marketplaces, positioned in the inverse C between Beeples/Picassos and Lambos/Top Shots, between NFTs in editions of 1 and NFTs in editions and 50 or 100… but no more.

And yet...

It’s easy to take the above as a pretty dire prognosis. A best-case scenario, after all, is that NFTs are in a massive bubble due to the relative scarcity of NFTs as a whole, and once they flood feeds and novelty wears off, the bubble will explode and clear the way for some decent, non-Beeple artists to make work. Ultimately, the NFT craze is a reminder that crypto patrons, like so many art collectors, want to have it both ways. We want to make digital goods freely accessible to the masses, and we want to own them solely for ourselves; we want to leave materialism behind, and we want as much status as we can acquire online instead; we want to decentralize power from corporations to the masses, and we want to make as much money as humanly possible.

There are, however, great uses for NFTs as the internet continues to disintermediate media companies and directly subsidize creators instead. One way to understand their genuine value is to imagine the two-decade turn from ownership of media in a physical world (circa 2001) to subscription models in a digital world (2021). Of course, not having to buy, own and dispose of movies, music, newspapers, and textbooks—or in some cases cars (thanks to Uber) or even homes (thanks to Airbnb)—can have massive advantages, particularly in expanding access to items on-demand. Subscriptions have made sense not only ideologically in the “Experiences Over Things” era, but because digital goods themselves are more like ephemeral experiences than tangible things. It is of course preferable to experience The Rescuers Down Under as an experience, available at a push-of-a-button, than Blu-ray or, god forbid, VHS tape that accumulates dust in the den.

Still, subscriptions incur one major trade-off: the ability of anyone to sell the good, particularly if it’s gained value over time. In the case of The Rescuers Down Under VHS or a New York Times print edition, the physical item is unlikely to be worth much unless it becomes a collectible, but that’s also because the physical item is just a representation of underlying intellectual property that someone else really owns (Disney and the New York Times, respectively). If the financial logic of NFTs has been all-too-close to art world economics, their real innovation so far has been to enable content creators to sell their goods directly to consumers and stipulate commissions from resales as well. A number of platforms allow creators to monetize digital work in open informational ecosystems, both subsidizing creators directly for their efforts while enabling data to be shared more openly. For example, Ocean Protocol lets institutional researchers sell their findings as NFTs of sorts to other institutions while Radix envisions a marketplace for developers to share components and build off each other’s work.

But we can go even further by allowing all users to be “patrons” who not only support favorite creators, but get some kind of stake in their creations. Mirror has been playing with a model that allows publications like The Generalist to sell tokens funding their research; if future subscribers/buyers pay more, the original funders will share in the proceeds. Chiliz lets fans own and trade tokens of sports teams that give them some governance rights. Chiliz’s tokens may not exactly be NFTs, but they follow the same logic as expensive, limited edition memorabilia—but memorabilia that gives the owners rights they never would have had in subscribing to watch the games.

Jesse Walden recently coined the phrase “Patronage+” to describe the ways that patrons can take ownership rights across media, with a particular focus on resales. Speaking this week on Invest Like the Best, Walden explained that:

“When you buy an NFT, you actually own some digital property that can be transferred, you can't do that with your subscription to Substack or Patreon. But when you buy an NFT, you're buying digital property. Even if you don't plan to resell, there's this vague idea that maybe in the future, someone else will want to buy this, maybe the creator becomes more popular… because you actually own something, and you can benefit potentially from the resale of that ownership value.”

Walden’s examples for NFT ownership across music, essays, and tweets all focus on the ways that media content can be resold by a few eager superfans in 21st century art markets. Still, NFTs offerways for creators to fund and monetize their work well beyond putting them into a speculative market of art and collecors. Projects like INX and Dusk and LABS, for example, have started working on tokenizing securities so that fans could all co-own music catalogs and consumers could own and trade part of their equity in specific real estate.

But the example of The Generalist allows us to start to imagine a combined subscription-ownership model in which patrons would get something very concrete for their purchase of a token, and the token would in turn have very real value as something more than a collectible. Imagine, for example, a publication that sold off one million tokens, each equal to one subscription. Buyers could purchase multiple tokens and resell them over time at market value—which could actually help the publication not only fund itself from the start but gain more money over time as token prices went up with limited supply. We can start to imagine all future creations being crowd-funded in exchange for equity.

There is still a lot that’s potentially dystopian about the scenario above: the equation of journalistic value with token prices, the limited availability of information to paid subscribers, and the auction-like pricing that could lead writing to be purchased as a luxury good for the ultra-wealthy. At the same time, however, it proposes a model in which writers can thrive and gain value over time, and a model in which supporters get something in return for their support, without any need for advertising or a publishing firm’s bureaucratic middle-men. This is the real promise of NFTs: that when the creator economy rests on a patron economy, both parties can disintermediate unnecessary corporate structures to grow each other’s value.

***

With huge thanks to Mario Gabriele and David Curtis for their insights and edits.

–

This article originally appeared on Three quarks – deep dives into crypto and web3: what does the past of tech, culture, and economics tell us about their future?

Comments (12)

Vlad Goncharov

Web3 programmer

staj hesap

aaaa

owens sheppard

Love

Aadil Mclean

NA

patricia lawmaker

Co founder

More stories

Aaron O'Leary · Announcements · 2 min read

Introducing Shoutouts

Finn Lobsien · Opinions · 5 min read

Can Devin AI Replace Product Managers?

Aaron O'Leary · News · 2 min read

Meet Nvidia's new localized AI chatbot

Sarah Wright · News · 2 min read

The top 15 AI products from 2023