Do you use neo.tax?

What is neo.tax?

neo.tax automates the R&D Tax Credit, giving startups roughly an extra month of burn. It's cheaper, faster and more accurate than human CPAs. It only takes 15 minutes to cut burn and extend runway without cutting headcount. Claim the money your startup’s owed!

Recent launches

neo.tax 2.0

unlock tax credits for startups!

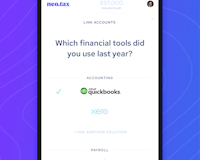

10% back on payroll in 10 min + IRS agent in your pocket

eligible if you make <$5M revenue + have US employees

reverse-engineered IRS audit methods + $1M guarantee

neo.tax

neo.tax automates the R&D Tax Credit, giving startups roughly an extra month of burn. It's cheaper, faster and more accurate than human CPAs. It only takes 15 minutes to cut burn and extend runway without cutting headcount. Claim the money your startup’s owed!

💡 All the pro tips

Tips help users get up to speed using a product or feature

📣 Calling all experts and enthusiasts! Share your wisdom and leave a pro tip that will make a difference!