Do you use FounderPool?

#3 Fintech Product of the Year

More recipients →What is FounderPool?

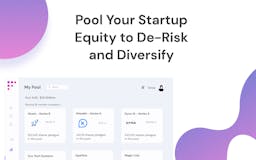

Pool your startup equity with inspiring, VC-backed founders vested in your success. Diversify your financial risk and increase your odds of an exit. FounderPool is your go-to resource for Investor Intros, Hiring Referrals, Growth Advice, Partnerships & more.

Recent launches

FounderPool

Pool your startup equity with inspiring, VC-backed founders vested in your success. Diversify your financial risk and increase your odds of an exit. FounderPool is your go-to resource for Investor Intros, Hiring Referrals, Growth Advice, Partnerships & more.